Press Release

Hong Kong Various sectors unite to fight against epidemic

(April 12, 2022, Hong Kong) The number of confirmed COVID-19 cases and death in Hong Kong has shown a continuous downward trend. Various Sectors continue to work together and take active actions to contribute to the fight against the epidemic. On April 10, Lin Xiaohui, an election committee member of Hong Kong's grassroots community, said that with the backing of the PRC Government, Hong Kong has sufficient supplies of anti-epidemic materials, protective equipment, and living materials. Many community isolation facilities assisted by the central government were quickly completed one after another, which is a great support for Hong Kong.

Your browser does not support HTML video.

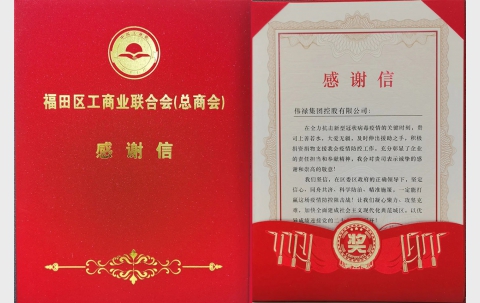

Realord Group receives a thank you letter from Futian District Federation of Industry and Commerce

(12 April 2022 – Shenzhen) Realord Group received a thank you letter, and "The Outstanding Contribution Award in Fighting the COVID-19 Epidemic in Futian District" from Shenzhen Futian District Federation of Industry and Commerce. The awards are given to thank chairman of Shenzhen Futian District Federation of Industry and Commerce, the chairman of the board of directors of Realord Group Holdings Co., Ltd., and the Hong Kong Taxi Drivers Association ( "HKTDA"). Dr. Bryan Lin Xiaohui, and Mr. Linus Lin, member of the 6th CPPCC Standing Committee of Futian District and Vice Chairman of Realord Asia Pacific Securities Co., Ltd. for their timely help at the critical moment of fighting against COVID-19 epidemic, and actively donating money and materials to support the prevention and control work, which fully demonstrates the corporate responsibility and dedication.

After the outbreak of the epidemic, the youth members from HKTDA responded to the call from the government and immediately launched the volunteer drivers campaign.. About 100 taxis are not only provide instant services to medical staff and volunteers, but also actively involved in the transportation of anti-epidemic materials and other related work. In addition, knowing that the supply of rapid test kits for COVID-19 on the market is tight and citizens' demand for testing is increasing, Linus Lin, actively fulfilled his social responsibilities and cared for the public's urgency. Donation includes 1 million Hong Kong dollars and 30,000 sets of rapid COVID-19 test kits to help Hong Kong citizens to overcome the difficulties and fight the epidemic together.

Realord Group Announces FY2021 Annual Results Recorded Revenue of HK$1.2 billion and Net Profit of HK$122 million

(1 April 2022 – Hong Kong) Realord Group Holdings Limited (the “Company”, together with its subsidiaries, the “Group”, stock code: 1196) is pleased to present the consolidated results of the Group for the year ended 31 December 2021. Over the period, the Group recorded a total revenue of approximately HK$1,195.1 million, representing a year-on-year growth of 37.5%; Gross profit was HK$272.8 million, representing a year-on-year increase of 35.6%; Income before tax and net profit for the Year was HK$115.9 million and HK$122.2 million respectively. Earnings per share for the Year was HK 8.49 cent.

Business Review

The principal activities of the Group during the year included the Property Segment, the Financial Services Segment, the EP Segment, the MVP Segment, the Commercial Printing Segment, the Hangtag Segment, the Department Store Segment and the Caribbean Segment.

The Property Segment

Properties investment, development and commercial operation has been one of the major development strategies for the Group’s overall business deployment and development goal. The Group holds three investment property projects namely Realord Villas and Zhangkengjing Property in Longhua District, and Realord Technology Park in Guangming District in Shenzhen, the PRC. The Group also holds proposed development project and properties under development namely Laiying Garden in Nanshan District and Qiankeng Property in Longhua District respectively in Shenzhen, the PRC. There are five property projects on hand as at 31 December 2021.

The revenue of the Property Segment was mainly derived from the rental income of the Group’s investment properties. The Group generated rental income of approximately HK$9.9 million and a segment profit of approximately HK$792.3 million in FY2021.

The Financial Services Segment

The Financial Services Segment generated a revenue of approximately HK$142.6 million in FY2021, representing a significant increase of 73.7% from the previous year. The segment recorded a segment profit of approximately HK$45.9 million in FY2021. The growth of both revenue and segment profit of the Financial Services Segment was mainly attributable to increase in services provided to its customers, including placing services and underwriting services for certain initial public offering (“IPO”) projects as well as the increase in margin interest income, margin financing services and interest from the money lending. Furthermore, the segment profit was significantly improved by the reversal of impairment losses of approximately HK$4.1 million on loan receivables in FY2021, comparing to initial recognition of impairment loss of approximately HK$20.6 million in FY2020.

The EP Segment

With the increased scale and established suppliers’ network of Realord Environmental Protection Japan Co., Ltd. (“Realord EP Japan”) during FY2021, the EP Segment generated revenue of approximately HK$672.8 million, representing an increase of approximately 23.7%. The segment profit for the EP Segment in FY2021 was HK$9.4 million.

The MVP Segment

During the difficult time of COVID-19 pandemic, the Group not only maintained a stable source of supply of motor vehicle parts, but also increased its sales to major customers. The revenue of the MVP Segment increased by approximately 35.7% in FY2021 to approximately HK$216.2 million. The segment profit significantly recorded a year-on-year growth of 40% to HK$8.7 million in FY2021.

The Commercial Printing Segment

The revenue from the Commercial Printing Segment decreased to approximately HK$58.3 million in FY2021 and it recorded a segment loss of approximately HK$4.1 million.

The Hangtag Segment

The revenue of the Hangtag Segment amounted to approximately HK$0.2 million in FY2021. The segment loss derived from this segment was relatively minimal.

The Department Store Segment

The Department Store Segment generated a revenue of approximately HK$95.0 million from its operation of department stores after completed the acquisition of Sincere in May 2021. The Department Store Segment recorded a segment loss of approximately HK$19.2 million in FY2021 due to the persistence impact of COVID-19 pandemic adversely affecting performance of department store operation.

The Caribbean Segment

The principal business of the Caribbean Education Group is the development of a project (“Project”) in Grenada (comprising 3 lots of land with admeasurement 450 acres situated at the Mt. Hartman area in the parish of Saint George). The Project involves the development of a mixed property project consisting educational facilities, apartments for student, residential properties, hotel and resort facilities, commercial development and shopping facilities and in a longer plan university establishment(s) and related amenities.

Through the CBI Programme, an investment programme of Grenada, the Caribbean Education Group is authorised to raise capital from investors of the Project for funding the construction and development costs. Qualified investors of the real properties will be granted permanent Grenadian citizenship and a passport offering visa-free travel to over 153 countries including the United Kingdom, EU Schengen countries and China. Grenada also offers access for its citizens to the United States of America E2 treaty investor visa which would enable the visa holder to reside, work and study in the United States. The Project marks a significant flag of our Group into the Caribbean region.

OUTLOOK AND CORPORATE STRATEGY

The Property Segment

The Group will focus on the five properties on hand, namely, the Qiankeng Property, the Laiying Garden, the Realord Villas, the Realord Technology Park and the Zhangkengjing Property to ensure that the Group stays in a good position in this segment.

The Finance Services Segment

The Financial Services Segment of the Group is highly correlated to the debt and capital markets in Hong Kong. It is expected that the ongoing political tension between United States of America and China would push more Chinese enterprises go for listing on the Stock Exchange of Hong Kong. With the new listing regime for SPACs in Hong Kong, the Group expects its Financial Services Segment could still achieve a steady business growth in the near future. The Group is in the course of optimizing its software systems in relation to securities transaction while expanding its sales and marketing force. The Group is currently preparing to launch dark pool and U.S. stock trading systems.

The EP Segment, the MVP Segment, the Commercial Printing Segment, the Department Store Segment and the Hangtag Segment

Looking forward, amidst the market uncertainties, the Group will continue to exercise extreme cautions in the operations of the EP Segment, the MVP Segment, the Commercial Printing Segment, the Department Store Segment and the Hangtag Segment with a view to controlling operating costs, minimising the credit risk exposures, and expanding the customers base of the segments by strengthening their competitive edges among their competitors.

The Caribbean Segment

The Project presents a valuable opportunity for the Group to diversity its business and operations in the Caribbean region and enables it to expand its scale of operation overseas. Other than the Project, the Group’s major operating arm for the Caribbean Segment, the Caribbean Education Group, is also in negotiation with the authorities of the Republic of Panama on a property development and power generation project to be granted under the foreign investors investment scheme of the Republic of Panama.

Following the initiative of One Belt One Road of the PRC government, the Group has further targeted five countries in the Caribbean economic zone, namely Grenada, Antigua, Saint Lucia, Saint Kitts and Dominica, as its new spheres of development. It is the corporate strategy of the Group to set up and develop new business in the arenas of (i) green energy; (ii) retail; (iii) education; and (iv) tourism in these countries.

The green energy business will encompass the government policies of the relevant countries in achieving carbon neutrality, and establishing a sustainable clean energy hub in the region. The Group plans to invest in BOT (build-operate-transfer) approved projects by the local governments. Such BOT projects include but not limited to power storage facilities, power management and grid management systems, solar power generation and application of solar power in infrastructure and buildings.

Regarding the retail business, it will be carried out in the retailing brand name of “Sincere” and will form an integral part of the property development and investment activities of the Group in the area. It is contemplated that the education sector would take the business model of the Project, in that it will combine the property development, student residence, commercial and shopping amenities and educational facilities in an overall development plan. Alongside will be the development of tourism related operations including hotels and holiday resorts and shopping complex in tourist areas.

To encourage foreign investments in to their countries, the above named Caribbean countries have long established citizenship by the CBI Programs and are well-recognised by potential investors. Grenada, Antigua, Saint Lucia, Saint Kitts and Dominica were the top five countries ranked as the most popular investment destinations by CBI Programs. To this end, the Group will establish a strong team of management, marketing and sales team to promote the investment targets, with offices in Beijing, Shanghai, Shengzhen, Hong Kong, South East Asia and North America.

Mr. Lin Xiaohui, Chairman of Realord Group said, “We, through multi-faceted and multi-dimensional efforts, to promote our development in the Caribbean and Latin America region, occupying strategic high ground in different countries, and actively utilising the market synergy to realise the leading position of the Group in the Caribbean and Latin American region segments, in order to maximise the return to our Shareholders and Investors.”

Sustainability to attain business excellence: Realord Group and Realord Asia Pacific Securities won "Outstanding Diversified Integrated Enterprise 2021" and the "Outstanding Securities Services Development 2021"

On March 30, "Quamnet Outstanding Enterprise Awards 2021" ("QOEA") announced the awarded enterprises, with eight enterprises being awarded for nine awards. Realord Group Holdings Limited (stock code : 1196.HK, hereinafter referred to as "Realord Group") and it subsidaries Realord Asia Pacific Securities Limited ( "Realord Asia Pacific Securities") respectively won the "Outstanding Diversified Integrated Enterprise 2021" and the "Outstanding Securities Services Development 2021".

The judging panel of QOEA is formed by the Quamnet editorial team, Quamnet research team, and independent financial analysts. Each nominated enterprise is required to submit their company profile and the self-evaluation report for assessment and selection. The committee will then use eight categories to select the most representative enterprises. The eight categories include excellent products and services, brand reputation, philosophy of operation, marketing strategies, sustainable development strategies, accomplishments, corporate social responsibility and unique business philosophy or development.

The 13th Quamnet Outstanding Enterprise Awards is themed by “Sustainability to Attain Business Excellence”, recognizing enterprises’ full dedication in operation and resilience in times of challenges, as well as the outstanding management on environmental, social and corporate governance. The performance sets a new standard of sustainable development for peers and the society as a whole.

Awarded companies come from diversified industries in Hong Kong, including financial services, MPF services, immigration advisory, ICT solution provider, logistics, transportation infrastructure and healthcare service etc. Among them, Realord Group and Realord Asia Pacific Securities have won this honor for the second consecutive year.

Sincere Mall Fights Against COVID-19 epidemic

(March, 28 2022, Hong Kong) In March 2022, owing to the COVID-19 pandemic, Sincere Shopping Mall where is located in Guanhu Street, Longhua District, owned by Realord Group Holdings Limited (SEHK stock code: 1196), actively responds the PRC government's advocation and is dedicated to figthing against the epidemic. Led by the Guanhu Street and Luhu Community of the PRC Government, a community testing center is setup next to Sincere Mall, while the community volunteers and Sincere Mall tenants quickly participate in this campaign with practical actions to show their responsibilies serving the citizen.

Your browser does not support HTML video.

Representatives of various sectors in Hong Kong expressed their support for the fight against the COVID-19 pandemic

(Feb 20, 2022, Hong Kong) In response to fight against COVID-19 pandemic, Representatives of various sectors in Hong Kong have recently launched 16 anti-epidemic measures, which have been widely approved and have strengthened the confidence and determination of all sectors to overcome the epidemic. The measures include fully safeguarding Hong Kong's epidemic prevention and the supply of living materials; increasing Designated Hotels for Quarantine as isolation places; setting up more Community Vaccination Centres in some shopping malls and office buildings; recruiting 100 taxis and vehicles as a designated taxi fleet transporting front-line staff and volunteers who fight against the epidemic.

Your browser does not support HTML video.

Various sectors in Hong Kong community: Beijing 2022 Winter Olympics Opening Ceremony Shows China's Power

(Feb 4, 2022, Hong Kong) On February 4th, the opening ceremony of the Beijing 2022 Winter Olympics was held in the Bird's Nest while the Hong Kong citizens were watching TV and keen to express their excitement and happiness. Various sectors in Hong Kong community said that the opening ceremony of the Beijing Winter Olympics was "simple, secure and exciting" as a whole, showing China's Great Power and they really looked forward to the athletes performing well in this game.

Dr. Bryan Lin, Chairman of Realord Group (HKSE stock code: 01196) , The Sincere Company (HKSE stock code: 00244) and Taxi Drivers & Operators Association, was very happy and proud of China. He said that Beijing is the first city where held two Olympics games in history. As a Chinese, he feels the prosperity and strength of the motherland and is very proud of it. He also said that he was looking forward to the next exciting competitions after opening ceremony, and hoped that teams from China and Hong Kong, China could achieve excellent results.

Suki Su, CEO of The Sincere Company, said that this Winter Olympics adheres to the concept of "green, sharing, openness and integrity". This concept is very good and environmentally friendly, and has achieved sustainable development. She thought the mascots "Bing Dwen Dwen" and "Xue Rong Rong" are very cute, and hoped that the Chinese Hong Kong team could achieve good results.

Linus Lin, Chairman of the Hong Kong Youth Association and Vice Chairman of Realord Asia Pacific Securities Limited, said that he prefers watching the short track speed skating games, because the whole competition is relatively compact and more exciting. What's more there are players from Hong Kong, China, so he was really concerned about it and hope they could get good results and even win medals.

Your browser does not support HTML video.

![2022-04-12 香港各界積極舉行多項防疫抗疫行動 團結一致抗擊疫情.mp4_snapshot_00.09_[2022.05.12_10.57.44]](img/?width=480&height=303&bg=f3f3f3&file=upload%2Fpress%2F128%2Fphoto%2F627c8b3a91b0e.jpg)

![2022-02-20 香港 香港社会同心抗疫行动会商会推出防疫抗疫举措 香港各界广泛赞同 齐心协力应对疫情.mp4_snapshot_01.19_[2022.05.12_11.16.36]](img/?width=480&height=303&bg=ebebeb&file=upload%2Fpress%2F124%2Fphoto%2F627c7c06f10ef.jpg)

![2022-02-05 香港各界:北京冬奧會開幕式展現大國風采.mp4_snapshot_00.26_[2022.05.12_11.28.52]](img/?width=480&height=303&bg=ebebeb&file=upload%2Fpress%2F122%2Fphoto%2F627c88c4ed3e6.jpg)