Press Release

Realord Group Wins "Leading 9+2 The Best Real Estate Development Award of Guangdong-Hong Kong-Macao Greater Bay Area"

(March 19, 2021, Hong Kong) Realord Group Holdings Limited ("Realord Group" or "Company", together with its subsidiaries are collectively referred to as "the Group", stock code: 01196.HK) is pleased to announce that Realord Group has won the "Best Real Estate Development Award of Guangdong-Hong Kong-Macao Greater Bay Area".

The first "Leading 9+2" Guangdong-Hong Kong-Macao Greater Bay Area Development Forum and Award Ceremony was held in the morning. The Chief Executive of Hong Kong Special Administrative Region Carrie Lam attended the forum and delivered a speech. The forum invites political and business leaders of Guangdong, Hong Kong and Macao, entrepreneurs, and authoritative experts to participate in the discussion, focusing on the achievements and opportunities of economic development in the Greater Bay Area, looking for business opportunities and cooperation. The forum set up an award ceremony to commend leaders from all sectors who have made outstanding contributions to the development of the Greater Bay Area, so as to inspire people, encourage all walks of life, jointly build the Greater Bay Area.

The award ceremony was jointly organized by the Hong Kong Tai Kung Wen Wei Media Group, the Hong Kong Chinese Enterprise Association, the Hong Kong Guangdong Association of Associations, and the Greater Bay Area Financial Technology Promotion Association. A total of 10 awards were awarded and more than 70 listed companies were awarded.

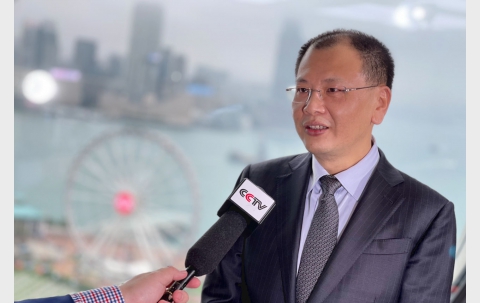

CCTV interview: Dr. Bryan Lin says the principle of "Patriots Administering Hong Kong" must be fully implemented.

On the evening of March 7th, 2021, CCTV's Xinwen Lianbo reported a section of news named "All walks of life in Hong Kong urgent to improve Hong Kong Special Administration Region(SAR) 's election system and the importance of the fundamental principle of 'Patriots Administrating Hong Kong' implementation", in which had interviewed Dr. Bryan Lin, Member of the Committee of Chinese People’s Political Consultative Conference in Shenzhen, Guangdong Province, Member of the Standing Committee of Chinese People’s Political Consultative Conference in Futian District, Shenzhen, Vice Chairman of Shenzhen Federation of Industry and Commerce (General Chamber of Commerce), Chairman of Shenzhen Futian District Federation of Industry and Commerce (General Chamber of Commerce), Chairman of Taxi Drivers & Operators Association, and Chairman of Realord Group Holdings Limited.

Your browser does not support HTML video.

Lin said, in the past period of time, the anti-China chaos in Hong Kong had colluded with foreign forces and used loopholes in the electoral system to enter the governance structure of the SAR, endangering Hong Kong's long-term stability and national security. It is necessary to keep pace with the times and improve the electoral system as soon as possible. Their conspiracy must not be succeed. This is not only conducive to safeguarding the interests of the people of Hong Kong, but also to safeguarding national sovereignty, security and development interests. The people of Hong Kong all hope for a stable and safe society. Especially as a member from the industrial and commercial sector, I am convinced that only social stability brings economic prosperity. Facts have proved that to maintain Hong Kong's prosperity and stability, we must fully implement the principle of "Patriots Administering Hong Kong". Only do patriots govern Hong Kong well. Improving the electoral system of the Hong Kong Special Administrative Region is beneficial to Hong Kong and conforms to the long-term interests of both People's Republic of China and Hong Kong.

Realord Group & Realord Asia Pacific Securities Win “Outstanding Diversified Integrated Enterprise 2020” and “Outstanding Securities Services 2020” of “Quamnet Outstanding Enterprise Awards“

(February 25, 2021 - Hong Kong) Realord Group Holdings Limited (“Group” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 01196.HK) is honored to announce Realord Group and Realord Asia Pacific Securities Limited (“Realord Asia Pacific Securities”) are respectively awarded “the Outstanding Diversified Integrated Enterprise 2020” and “Outstanding Securities Service Development 2020” of “Quamnet Outstanding Enterprise Awards“ (“QOEA”).

Dr. Bryan Lin, Chairman of Realord Group, said, “We are honored to win two “Quamnet Outstanding Enterprise Awards” given by Quamnet. We sincerely thank the industry who supports and affirms Realord Group and Realord Asia Pacific Securities’ efforts and performances over the past year. Looking forward, we see both challenges and opportunities, the Group will continue to strike and uphold the corporate philosophy of ‘innovative development and the pursuit of excellence’, optimize the operation management and resource allocation of our business segments, namely property investment, financial services, environmental protection, and vehicle parts, so as to enhance the company value for our shareholders actively.

Realord Group Holdings Limited Chairman Dr. Byran Lin

Realord Asia Pacific Securities Limited Chairman Mr. Michael Chan

About Quamnet Outstanding Enterprise Awards

The Quamnet Outstanding Enterprise Awards, launched since 2009 by Quamnet, a leading financial website in Hong Kong, not only focuses on the financial field, but also the accomplishments of Hong Kong industries. The "Quamnet Outstanding Enterprise Awards (QOEA)" was designated to identify and highly praise the excellent performance of Hong Kong enterprises.

Formed by the Quamnet editorial team, Quam research team, and independent financial analysts, the judging committee of QOEA appraises and picks the best representative enterprises on eight categories, namely excellent products and services, brand reputation, philosophy of operation, marketing strategies, sustainable development strategies, accomplishments, corporate social responsibility and unique business philosophy or development.

Realord Chairman Dr. Bryan Lin wishes you a Happy Chinese New Year 2021

The Year of the Ox is coming. On behalf of Realord Group, I would like to express my sincere greetings and festival wishes to everyone at such a wonderful moment.

2020 was an extraordinary year. In face of the challenges, Realord staff have been diligent in their works and the support for epidemic prevention. Their outstanding performances were really satisfactory.

2021 is the Group’s 16th anniversary. In the past 16 years, we have put efforts in moving forward and actively encountering to various opportunities and challenges. Realord has grown from scratch and achieved multiple blossoms in various business segments such as environmental protection, financial service , property investment as well as vehicle parts.

We are grateful that the era has given us a superior development environment and chances, and all these achievements are attribute to all Realord staffs' efforts. I would like to take this opportunity to show my heartfelt gratitude and respect to all of our hard-working colleagues and friends who care and support the Realord!

Time changes and our dream will come true. As the beginning of the "14th Five-Year Plan", 2021 will also be a crucial year for Realord Group's development and innovation. Hopes, opportunities and challenges coexist. We must start our new journey, forge ahead and overcome the difficulties, writing a new chapter for the Group's next fifteen years development!

Finally, wish you a happy Chinese New Year. Thank you!

Realord Chairman Dr. Bryan Lin Wins “Advanced Individual” of “Shenzhen Futian Mangrove Award”

(November 26, 2020 - Shenzhen) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce that Realord Group Chairman Dr. Bryan Lin, Xiaohui won “Advanced Individual” of “Shenzhen Futian Mangrove Award”.

Organized by the Shenzhen Futian District Committee and the District Government, the Shenzhen Futian Mangrove Award” ceremony was held in the TV studio of Shenzhen Broadcasting Group. 30 “Advanced Collectives” and 60 “Advanced Individuals” were awarded in the ceremony.

This year marks the 30th anniversary of the establishment of Futian District. The Futian District Committee and the District Government debuted the "Mangrove Award" to commend both advanced collectives and individuals, to showcase the outstanding achievements of Futian District among 30 years of reforms and development, and to inspire the people of Futian District with the exemplars to carry forward the spirit of the Shenzhen Special Economic Zone, to promote the construction of "Dual-Zone Construction", "Six First-Demonstrations" and "Six Model Urban Areas".

Dr. Lin Xiaohui, Chairman of Realord Group, said: "It is my honor to receive this award, as a recognition of my works of member of the Standing Committee of the Futian District CPPCC and Chairman of the Futian District Federation of Industry and Commerce so far. As this year is also known as the 40th anniversary of Shenzen, and the 30th anniversary of Shenzhen Futian District. I will keep contributing to Shenzhen as return with higher starting point, level and goals, as much as I can. "

Dr. Bryan Lin: Where there is an opportunity in Shenzhen, also there is an opportunity in Hong Kong

On the evening of October 15th, 2020, CCTV-News issued an article "A wide range of people in Hong Kong appraise China PRC President Xi Jinping’s important speech to seize the major historical opportunity of planning and create new miracles together in the Greater Bay Area" in which had interviewed Dr. Bryan Lin, Member of the Committee of Chinese People’s Political Consultative Conference in Shenzhen, Guangdong Province, Member of the Standing Committee of Chinese People’s Political Consultative Conference in Futian District, Shenzhen, Vice Chairman of Shenzhen Federation of Industry and Commerce (General Chamber of Commerce), Chairman of Shenzhen Futian District Federation of Industry and Commerce (General Chamber of Commerce), Chairman of Taxi Drivers & Operators Association, and Chairman of Realord Group Holdings Limited.

Dr Bryan Lin Xiaohui said: "President Xi summed up the achievements and experience of the Shenzhen Special Economic Zone over 40 years, and pointed out its future development. Where there is an opportunity in Shenzhen, also there is an opportunity in Hong Kong. The Greater Bay Area is an important carrier for cooperation between Shenzhen and Hong Kong. Shenzhen has been undergoing transformation in the past few decades, and now it has an outstanding performance in the innovative technology industry while Hong Kong’s financial industry still has its good foundation and advantages, so the cooperation between Hong Kong and Shenzhen could be much better. The connection of rules and mechanisms, mentioned by President Xi, are believed to reduce conflicts and make economic operations smoother."

Your browser does not support HTML video.

Realord Environmental Protection receives "Eco-partner - BOCHK Corporate Environmental Leadership Awards 2019"

On 6th October 2020, Realord Environmental Protection Industrial Company Limited, a member of Realord Group Holdings Limited (SEHK stock code: 1196) was awarded as an "EcoParter" from "BOCHK Corporate Environmental Leadership Awards 2019".

Co-hosted by The Federation of Hong Kong Industries (FHKI) and Bank of China (Hong kong) (BOCHK), the "2019 BOCHK Corporate Environmental Leadership Awards" was held that aims to encourage and promote environmental practices among the manufacturing and the services enterprises in Hong Kong and the Pan Pearl River Delta region to shoulder corporate social responsibility and create a green community.

Realord Environmental Protection Industry Company Limited is mainly engaged in the waste recyling, dismantling and sales of processing waste materials (such as copper, aluminum and plastics). Its main opertaion base is located in Osaka, Japan and Wuzhou, Guangxi Province. The Company contributed the revenue of approximately HK$171 million to the Group in the first half of 2020.

Vanguard LIFE Community Supermarket opens in Realord Vcity

Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 01196.HK) is pleased to announce the opening of China Resources Vanguard LIFE Community Supermarket in Realord Vcity.

Realord Vcity, the Group’s first community shopping mall located in Realord Villas in Longhua District, Shenzhen, is also the first community shopping mall in Lohu Subdistrict of Longhua District introducing China Resources Vanguard LIFE community supermarket. Launched by China Resources Vanguard Company Limited, "China Resources Vanguard LIFE" is another supermarket brand after Wanjia MART, which mainly focuses on satisfying consumers’ three meals a day and basic needs of home life, with increasing the proportion of the fresh food and providing more high-quality goods & commodities, etc.

Realord Villas is the Group’s first commercial and residential project in Huanguan South Road, Guanlan Street, Longhua District, Shenzhen. It is just less than 100 meters away from Hi-tech Zone East Station of Shenzhen Tram that is connected to Shenzhen Metro Line 4 and the bus stop is also located on there. The total construction area of the project is about 230,000 square meters covering 2016 housing units, a commercial apartment consisting of a shopping mall, retail shops and the parking spaces. Apart from the housing units belong to talent housing distributed by the Shenzhen Government, the commercial part with construction area of 51,039 square meters is owned by the Group. Realord Vcity is the Group first community shopping mall in Shenzhen which is built as business and shopping center that integrates local amenities, entertainment and leisure, parent-child education and special dining, and beverage experience, in order to create a warm and convenient space for a better community life.

At present, there are well-known brand stores such as Yizhan, Naber Pharmacy, and Qdama already stationed in Realord Vcity. As one of the pioneer shops stationing in Realord Vcity, Vanguard LIFE Community Supermarket will definitely bring a more assured and comfortable shopping experience to the community consumers.

![20201016.mp4_snapshot_00.35_[2020.10.16_15.03.02]](img/?width=480&height=303&bg=ebebeb&file=upload%2Fpress%2F91%2Fphoto%2F5f8945db3b99d.jpg)