Press Release

Vice Chairman of the National Committee of the Chinese People's Political Consultative Conference Zhou Qiang delivered a speech. NCCPPCC member Bryan Lin Xiaohui participated in the panel discussion

When discussing the government work report, the members attending the Third Session of the 14th National Committee of the Chinese People's Political Consultative Conference believed that the CPPCC should adhere to the guidance of Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, focus on the center and serve the overall situation, help promote high-quality economic development, and contribute to the promotion of Chinese-style modernization. Zhou Qiang, vice chairman of the National Committee of the Chinese People's Political Consultative Conference, said during a group discussion with members of the All-China Federation of Trade Unions that we must deeply understand the decisive significance of the "two establishments", resolutely implement the "two safeguards", adhere to the organic combination of party leadership, the united front, and democratic consultation, adhere to the unity of reform and the rule of law, and gather the power of progress through high-quality performance of duties.

Your browser does not support HTML video.

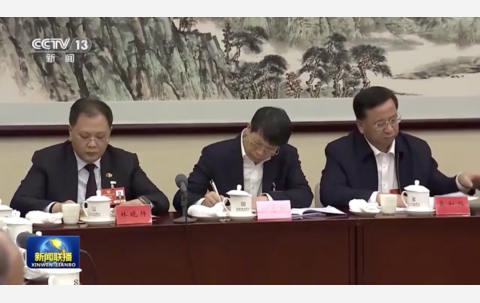

Ding Xuexiang discussed national affairs with CPPCC members from Hong Kong and Macao NCPPCC member Bryan Lin attended the meeting

On March 6, Ding Xuexiang, member of the Standing Committee of the Political Bureau of the CPC Central Committee and Vice Premier of the State Council, attended the joint group meeting of members of the National Committee of the Chinese People's Political Consultative Conference from Hong Kong and Macao. After listening carefully to the speeches of the members, Ding Xuexiang said that in the past year, the CPC Central Committee with Comrade Xi Jinping as the core has united and led the entire party and people of all ethnic groups across the country to successfully complete the main goals and tasks of economic and social development, and Chinese-style modernization has taken new and solid steps. With the strong support of the central government and under the leadership of the chief executives and governments of the SARs, Hong Kong and Macao have achieved new breakthroughs and shown new vitality in their development. Ding Xuexiang emphasized that we must shoulder the important mission of practicing "one country, two systems" in the new era, build a solid barrier to safeguard national security, consolidate and enhance the unique status and advantages of Hong Kong and Macao, promote Hong Kong and Macao to better integrate into the overall national development, and make greater contributions to building a strong country and national rejuvenation. I hope that all members will continue to work hard and make contributions to jointly write a new chapter of prosperity and development for Hong Kong and Macao.

Your browser does not support HTML video.

Bryan Lin, member of the National Committee of the Chinese People's Political Consultative Conference of Hong Kong, attends the 3rd Session of the 14th National Committee of the Chinese People's Political Consultative Conference

The 3rd Session of the 14th National Committee of the Chinese People's Political Consultative Conference opened in the Great Hall of the People in Beijing on the afternoon of March 4. Xi Jinping and other party and state leaders attended the opening ceremony. At the opening ceremony, the participating members of the National Committee of the Chinese People's Political Consultative Conference reviewed and approved the agenda of the 3rd Session of the 14th National Committee of the Chinese People's Political Consultative Conference, listened to the work report of the Standing Committee of the National Committee of the Chinese People's Political Consultative Conference and the report of the Standing Committee of the National Committee of the Chinese People's Political Consultative Conference on the work of proposals since the 2nd Session of the 14th National Committee of the Chinese People's Political Consultative Conference. During the two sessions, member Lin Xiaohui performed the functions of political consultation, democratic supervision, and participation in political affairs, focusing on the industrial upgrading of the Guangdong-Hong Kong-Macao Greater Bay Area, the introduction of talents for cooperation between Shenzhen and Hong Kong, and the innovative development of Hong Kong's financial market, and discussed national affairs and development with thousands of representatives and members from all over the country.

NCCPPCC member Bryan Lin:Hong Kong Kai Tak Sports Park will catalyze a new economic model of sports & tourism

Hong Kong Kai Tak Sports Park opened grandly on March 1. This largest sports infrastructure project in Hong Kong not only provides a new stage for local and international sporting events, but also becomes a new engine for Hong Kong to promote the development of the event economy and build a "city of events". Lin Xiaohui, member of the National Committee of the Chinese People's Political Consultative Conference of Hong Kong, chairman of the Realord Group and Sincerely, said in an interview with CCTV reporter Jin Dong that as a world-class top venue, Kai Tak Sports Park will leverage Hong Kong's event economy with international competitions and cultural events as a fulcrum. I believe that the holding of these events will also boost Hong Kong’s hotel retail, catering and other consumer chains and create long-term employment opportunities. At the same time, the park’s integration of sports, leisure and sports culture will not only enhance the city’s international image, but also catalyze a new economic model of sports + tourism, inject vitality into the community and consolidate Hong Kong’s position as the “city of events”.

The Sixth Session of the Seventh Shenzhen Municipal People's Congress opened, Bryan Lin Xiaohui, a member of the National Committee of the CPPCC and a standing committee member of the Shenzhen Municipal CPPCC in attendance

On the morning of February 25, the Sixth Session of the Seventh Shenzhen Municipal People's Congress commenced. More than 400 municipal people's congress representatives, bearing the trust of the people, attended the meeting and diligently carried out the sacred duties entrusted to them by the Constitution and laws. According to the meeting agenda, Shenzhen Mayor Qin Weizhong delivered the government work report on behalf of the municipal government. Bryan Lin Xiaohui, a member of the National Committee of the Chinese People's Political Consultative Conference (CPPCC) and standing committee member of the Shenzhen Municipal CPPCC, Realord Group (1196.HK), and The Sincere Company (0244.HK) Chairman attended the session.

Lin Xiaohui, a member of the National Committee of the CPPCC, standing committee member of the Shenzhen Municipal CPPCC, chairman of Realord Group, and chairman of The Sincere Company, commented that the government work report presented by Mayor Qin Weizhong summarized achievements in a factual manner, analyzed the current situation in an inspiring way, and outlined work plans systematically. Lin agreed and noted that the report possesses both a macroscopic strategic vision and a focus on microscopic livelihood challenges. Over the past year, new progress has been made in Shenzhen-Hong Kong cooperation. The mechanism for regular coordination and collaboration between Shenzhen and Hong Kong has become increasingly robust. Cross-border travel has become more convenient, and ties between the business communities have grown closer. The development and opening-up of Qianhai have taken on a fresh vitality, while the construction of Hetao has sparked a new wave of momentum. The government work report proposes that in 2025, the "Bay Area Connect" project will be advanced in depth, enhancing the "hard connectivity" of infrastructure and the "soft connectivity" of rules and mechanisms. Lin Xiaohui expressed particular agreement with this point, stating, "'Hard connectivity' is important, but 'soft connectivity' is even more crucial. 'Hard connectivity' is relatively easier to achieve, whereas 'soft connectivity' is a tougher challenge, requiring greater courage, determination, and innovative reforms." He further remarked that successfully achieving "soft connectivity" would carry even greater significance, expressing confidence that in 2025, the government will achieve significant breakthroughs in the "soft connectivity" of rules and mechanisms, thereby enhancing Shenzhen's role and influence as a national pilot demonstration zone.

The Fifth Session of the Seventh Shenzhen Municipal Political Consultative Conference opened National CPPCC member & Shenzhen CPPCC standing committee Member Bryan Lin attended Conference

On February 24, the Fifth Session of the Seventh Shenzhen Municipal Political Consultative Conference opened at the Shenzhen Hall. Lin Jie, Chairman of the Shenzhen Municipal Political Consultative Conference, delivered a work report on the Standing Committee of the Seventh Committee of the Shenzhen Political Consultative Conference. National Committee members of the Chinese People's Political Consultative Conference, standing committee members of the Shenzhen Municipal Political Consultative Conference, Realord Group (1196.HK) and The Sincere Company Chairman Bryan Lin Xiaohui, attended the conference.

Lin Xiaohui stated that Chairman Lin Jie’s report summarized the work of the Municipal Political Consultative Conference for 2024 from six aspects and made five main arrangements for work in 2025. He described it as a pragmatic and realistic report that he fully agreed. Over the past year, the Shenzhen Municipal Political Consultative Conference and Chairman Lin Jie have attached great importance to matters related to Hong Kong and Macau. They actively developed and strengthened Hong Kong and Macau patriotic forces , supported the re-election work of past Hong Kong and Macau committee associations, maintained close contacts with patriotic political groups and associations in Hong Kong and Macau, organized Hong Kong and Macau committee members to conduct national condition investigations, and united efforts to promote the steady implementation of "One Country, Two Systems." Chairman Lin Jie requested that in 2025, they continue to leverage the "dual positive role" of Hong Kong and Macau committee members while maintaining close ties with patriotic political groups and associations. As a member of the Hong Kong and Macau committee and a leader of a patriotic association in Hong Kong, Lin will continue to actively provide advice for governance this year, strive to build consensus, and make new positive contributions to promoting high-quality economic and social development in Shenzhen as well as to the practice of "One Country, Two Systems" in Hong Kong.

Lin Xiaohui believes that over the past year, the Standing Committee of the Municipal Political Consultative Conference has achieved remarkable results in proposal work, with a proposal response rate of 100% and 3,794 completed tasks. Regarding last year's proposal work, the Municipal Political Consultative Conference summarized four main practices that were very well articulated. Among these practices was organizing democratic supervision teams to focus on key social issues such as "reducing the burden on primary and secondary school teachers" and "management of electric bicycles," achieving visible results. He hopes this good practice will continue. He fully supports the four key points for proposal work in 2025, especially endorsing the implementation of a "look-back" cross-year tracking supervision for key proposals to understand the adoption and implementation status of proposal opinions and suggestions. This approach is very pragmatic; it helps ensure that good initiatives are well executed and sustained over time while effectively avoiding situations where relevant departments merely brush off proposals.

Chen Weiwen, Secretary of the Party Working Committee of Guanhu Street, Longhua District, Shenzhen visits Realord Group

On January 3, Shenzhen Longhua District Guanhu Street Party Working Committee Secretary Chen Weiwen, Party Working Committee Member Qi Jiashu and Women's Federation Director Huang Miaoling visited Realord Group's Hong Kong headquarters. Realord Group (1196.HK) and The Sincere Company (0244.HK) Chairman Dr. Bryan Lin Xiaohui and Realord Commercial Group General Manager Luo Xinwen warmly welcomed the guests and then arranged a meeting.

Dr. Bryan Lin first introduced in detail the business layout of Realord Group in recent years and the operation status of Sincere Mall in Longhua District. He also shared the Group's future development and emphasized that Realord Group has always been committed to cooperating with the government's development strategy, actively integrate into local economic construction, and contribute to enhancing regional commercial vitality and promoting industrial upgrading.

Chen Weiwen said that the main purpose of this visit is to further strengthen the interaction between the sub-district and key enterprises, to gain an in-depth understanding of the actual needs of the enterprises, and to jointly explore new paths and measures to enhance the business atmosphere of High-tech Park in Longhua District. He highly affirmed the operational achievements made by Realord Group and The Sincere Group, and praised the important role played by the companies in promoting regional economic vitality.

Dr. Lin Xiaohui expressed that he sincerely hoped that Secretary Chen Weiwen would be able to visit the Realord Garden Sincere Shopping Center in the future for on-site research and guidance, and provide more valuable suggestions for optimizing the business environment of the shopping center.

Bryan Lin Xiaohui, member of the NCCPPCC in Hong Kong, was interviewed by CCTV News: One country, two systems is the cornerstone of prosperity and stability in Hong Kong and Macao

The important speech delivered by China President Xi Jinping at the celebration of the 25th anniversary of Macao's return to the motherland and the inauguration ceremony of the sixth government of the Macao Special Administrative Region has aroused enthusiastic responses from the society in Hong Kong and Macao. They said that President Xi Jinping's important speech is inspiring and strengthening, and we must fully, accurately and unswervingly implement the "one country, two systems. With the strong support of the great motherland, we will surely open up new horizons for development and constantly create new glories. We will make greater contributions to the great cause of comprehensively advancing China's building of a strong country and national rejuvenation through modern development.

Xi pointed out that over the past 25 years since Macau's return to the motherland, with the strong support of the central government and the mainland, the Special Administrative Region government has united and led all sectors of society in continued efforts, and the practice of "one country, two systems" with Macau characteristics has achieved tremendous success. Today, Macau has achieved a historic leap in economic and social development, and its per capita GDP ranks among the highest in the world. It has established stable economic and trade relations with more than 120 countries and regions and is a member of more than 190 international organizations and institutions, attracting investors from various countries to invest, start businesses, participate in construction and share the fruits of development.

Xi's important speech also triggered a warm response from all walks of life in Hong Kong. Everyone said that President Xi Jinping's important speech is an action guide for advancing the steady and long-term practice of "one country, two systems" on the new journey. We must better play the advantages of the "one country, two systems" system and provide a solid foundation for the implementation of the "one country, two systems" policy. Chinese-style modernization will make new and greater contributions to the comprehensive advancement of China's construction of a strong country and the great cause of national rejuvenation.

Dr. Bryan Lin, member of the National Committee of the Chinese People's Political Consultative Conference in Hong Kong, president of the Hong Kong Environmental Practitioners General Association, and a Chairman of Realord Group and a Chairman of the Sincere Company, said: President Xi's important speech was sonorous and powerful. I deeply feel that "one country, two systems" is not only the crystallization of national wisdom, but also the prosperity and stability of Hong Kong and Macao. The cornerstone of. Looking to the future, we firmly believe that under the strong leadership of the central government, Hong Kong and Macao will continue to adhere to the original intention of "one country, two systems", continue to deepen reforms, and integrate into the overall national development.

![2025-03-06_1.mp4_snapshot_00.28_[2025.03.07_10.56.40]](img/?width=480&height=303&bg=ebebeb&file=upload%2Fpress%2F206%2Fphoto%2F67ca603a5c89a.jpg)