Press Release

Chairman of Realord Lin Xiaohui and Four Shenzhen’s CPPCC members Donate RMB 1 Million to Heyuan for Poverty-relief Work

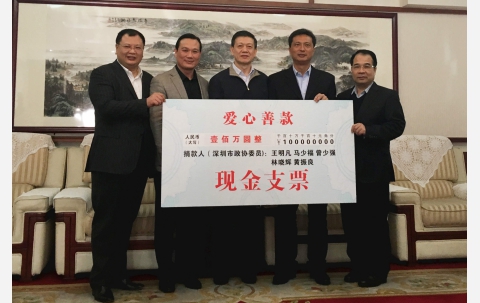

(December 15, 2016 – Heyuan City) Dr. Bryan Lin Xiaohui, Member of the Shenzhen Municipal Committee of the Chinese People's Political Consultative Conference (“Shenzhen CPPCC”) and Chairman of Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK), Mr. Dai Beifang, Chairman of Shenzhen CPPCC, and other officials visited Heyuan, and exchanged their ideas and views with municipal administration of Heyuan in Heyuan Guest House. All the guests were greeted warmly by Mr. Zhang Wen, Municipal Party Committee Secretary of Heyuan, and other officials. In this visit, Dr. Bryan Lin and other four CPPCC members together donated RMB 1 million to the Committee of the CPPCC of Heyuan (“Heyuan CPPCC”) to help poverty-relief work.

Mr. Liu Runhua, Executive Vice Chairman of Shenzhen CPPCC, Mr. Zhao Yanmin, Secretary-General, Mr. Pan Jiadong, Director of the Hong Kong, Macao and Taiwan and Foreign Affairs Committee, Mr. Cui Minrong, Director of Economic Relations Commission, Ms. Huang Mane, Deputy Secretary-General, Mr. Luo Jianlin, Secretary of Chairman Mr. Dai Beifang, Mr. Li Yang, Director of the Secretariat, Mr. Yuan Fayong, Deputy Director of Publicity and Information Department, Mr. Wang Mingfan and Mr. Huang Zhenliang, Shenzhen CPPCC members, also participated the visit.

Mr. Gong Zuolin, Chairman of Heyuan CPPCC, Mr. Zhong Mengteng, Standing Committee and Deputy Mayor of Heyuan, Mr. Liang Guohua, Vice Chairman of Heyuan CPPCC, Ms. He Anqiong, Municipal Political Consultative Committee member, Mr. Sun Feng, Deputy Secretary-General of Heyuan and Director of Executive Office, and Mr. Yang Sen, Director of the Economic Committee of Heyuan CPPCC, also attended the exchange meeting.

During the meeting, Heyuan & Shenzhen CPPCC leaders exchanged their progress of work. On behalf of Shenzhen CPPCC, Mr. Liu Runhua, Executive Vice Chairman of Shenzhen CPPCC donated RMB 1 million to Heyuan CPPCC for the use of poverty alleviation. Mr. Zhang Wen, Municipal Party Committee Secretary of Heyuan, represented Heyuan CPPCC to receive the donation.

The amount of this donation was made up from five Shenzhen CPPCC members including Mr. Wang Mingfan, Mr. Ma Shaofu, Mr. Zeng Shaoqiang, Dr. Bryan Lin Xiaohui, Mr. Huang Zhenliang respectively that each of them contributed RMB $200, 000. Mr. Liang Guohua, Vice Chairman of Heyuan CPPCC, represented Heyuan CPPCC to give literary and historical materials in return to Shenzhen CPPCC.

Mr. Zhang Wen, Municipal Party Committee Secretary of Heyuan, expressed his wholehearted appreciation for the visit of Mr. Dai Beifang and other officials. He gained much in the past several years during working with Mr. Dai in Shenzhen. Besides, Mr. Zhang also thanked for their generous donation and looked forward to both parties establishing a stronger connection and frequent cooperation in the future.

Mr. Dai Beifang, Chairman of Shenzhen CPPCC, said that the main purpose of this visit was to investigate and learn Heyuan’s development progress. Particularly, they wished to learn the experience and good style of work from Heyuan CPPCC through the exchange. Mr. Dai also praised Heyuan of achieving excellent results in the aspect of promoting the development of industrial park. Meanwhile, Heyuan is committed to the poverty relief work and able to get multiple enterprises and social organizations participated. They hoped that both parties can work closely and support each other precisely.

Dr. Bryan Lin Xiaohui stated that he has benefited a lot from the communication between CPPCC of Shenzhen and Heyuan. He saw Heyuan’s advantages on the development of eco-tourism and industrial park. He also expected the donation to inspire more groups and organizations to participate in poverty relief work.

Group photo: Dai Beifang, Chairman of Shenzhen CPPCC (Middle), Zhang Wen, Municipal Party Committee Secretary of Heyuan (Right 2), Huang Zhenliang, Shenzhen CPPCC member (Right 1), Dr. Bryan Lin Xiaohui, Chairman of the Group (Left 1) and Wang Mingfan, Shenzhen CPPCC member (Left 2).

Group photo: Shenzhen & Heyuan CPPCC officials

- End -

Realord Wins BIVA “Best Investment Value Award”

(December 12, 2016 – Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK), is pleased to announce that the Company received the “2016 Best Investment Value Award for Listed Companies (Market capitalization of less than HKD10 billion)” granted by the judging panel of the Best Investment Value Award for Listed Companies (“BIVA Award”).

Dr. Bryan Lin Xiaohui, Chairman of the Group, said: “We are grateful for the consistent recognition and praise by the committee of BIVA Award. Meanwhile, we would like to express our appreciation to our teams, clients, partners, investors, shareholders and other stakeholders that always provide us with numerous support. Looking ahead, we will continue to uphold the core value of 'innovative development and pursuit of excellence' and strive to do the best in our business which can generate more substantial returns for our investors and shareholders."

The Award Dinner of “2016 Best Investment Value Award for Listed Companies” is ceremoniously held at JW Marriott Hotel Hong Kong tonight. BIVA Award is jointly organized by prestigious financial services institutions, including compliance institutions, financial public relations companies, accounting firms, financial data providers and financial media with businesses across major financial hubs including Hong Kong, Singapore, Beijing and Shanghai, etc. BIVA Award is vigorously recognized as an objective and authoritative award for listed companies, which is also widely well supported by various financial media. The award aims to recognize those listed companies which have recently outstanding achievements in various sectors, and to enable the financial industry and public investor to have a better understanding of these listed companies. The selection criteria are based on various factors, including the dividend yields, return on investment, turnover rate, and investment potential, etc.

For more information about BIVA Award, please refer to http://www.biva.hk or https://www.facebook.com/awardbiva/

- End -

Realord Wins ‘Most Valuable Listed Company’ Award

(November 23, 2016 – Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK), is pleased to announce that the Group was named the “Most Valuable Listed Company” at The Sixth China Securities Golden Bauhinia Awards.

Organized by Ta Kung Pao, The Listed Companies Association of Beijing, The Hong Kong Institute of Chartered Secretaries, The Hong Kong Chinese Enterprises Association, Chinese Securities Association of Hong Kong, Chinese Financial Association of Hong Kong, and Hong Kong Securities Professionals Association, The Sixth China Securities Golden Bauhinia Awards ceremony took place at the Grand Hyatt Hong Kong on 23 November 2016.

Dr. Bryan Lin Xiaohui, Chairman of the Group, said: “Having affirmation and attention by the review committee and the community, we are honored to win this award. Our success relies on the support from our staff, customers and shareholders. In the future, we will keep maintaining the highest corporate governance and fulfil our responsibility to strive for substantial returns for our investors and shareholders.”

This award shows the Group’s outstanding performance in the capital markets, in particular in terms of shareholder returns, profitability, financial safety, sustainability, operating efficiency, corporate governance and brand value, all which attracted attention from investors and media.

The Sixth China Securities Golden Bauhinia Awards, jointly organized by Ta Kung Pao and Hong Kong and China-based professional bodies, is one of the most authoritative, scalable and credible evaluations of listed companies in recognition of the outstanding performance of listed companies and their senior management. The review is assessed by a number of professional securities institutions with strict impartial review processes. Apart from the comprehensive corporate information and governance experience, the review group also considers other indicators including companies’ self-recommendation and testimonials sent by the industry. This award helps the listed companies enhance their corporate image in the community.

- End -

High-ranking Government Official of the Comoros Visit Realord

(November 24, 2016 – Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK) is pleased to announce that Mr. Abdallah Said Sarouma, Vice-President of the Ministry of Transport, Post, Telecommunications and Information Technology for the Union of the Comoros (“Comoros”), together with other high-ranking officials, visited the Group.

Mr. Abdallah Said Sarouma (in brown suit) and other Comoros Leaders

During this trip, Mr. Sarouma introduced to the economic conditions of Comoros with Realord’s management and was keen on cooperation with overseas companies in aspects such as logistics, shipping and infrastructure for mutual prosperity.

Mr. Lin, Xiaodong, Executive Director of Realord, said: “We are very honored to have the Comoros’ leaders visiting us. Leveraging on this opportunity, we got to know much more about the status quo, culture and customs of Comoros and look forward to having further communications and exchanges.”

Also known as “country of the moon,” Comoros is a sovereign archipelago nation in the Indian Ocean located at the northern end of the Mozambique Channel off the eastern coast of Africa between northeastern Mozambique and northwestern Madagascar. It is approximately 300 km away respectively from Mozambique and Madagascar. With the total area of the country 2,236 sq km, the population of Comoros is approximately 800,000. The capital of Comoros is Moroni. In the 19th century, Comoros was a French colony. It voted for independence from France on July 6, 1975. Comoros' economy is dominated by agriculture, and abounds in vanilla, cloves and manoranjini. The output of these in Comoros occupy top spot worldwide, which has helped Comoros earn the title of “The Spice Island.”

- End -

Realord Successfully Holds “Linking Shenzhen-Hong Kong Stock Connect” Investor Presentation

(October 28, 2016 – Shenzhen) Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK) held an investor presentation titled “Linking Shenzhen-Hong Kong Stock Connect” on last Friday through this critical moment for the forthcoming Shenzhen-Hong Kong Stock Connect. Hosted by Dr. Lin Xiaohui, Realord’s Chairman, Lin Xiaodong, Executive Director and Chan Ying Kay, Chief Financial Officer and Company Secretary, the presentation attracted over 30 institutional investors, fund managers and media from Hong Kong and Mainland China to participate.

(From left) Chan Ying Kay, Chief Financial Officer&Company Secretary, Dr. Lin Xiaohui, Chairman, Lin Xiaodong, Executive Director

“Linking Shenzhen-Hong Kong Stock Connect” investor presentation was successfully held at Futian Shangri-La, Shenzhen at 4:15pm on 28th October. Dr. Bryan Lin shared the Realord's latest business and plans for the future development. He pointed out that the group has been actively expanding to the diversified and fast growing businesses this year to prepare for the launch of Shenzhen-Hong Kong Stock Connect. For instance, in May 2016, the Company announced to establish a joint venture securities company Yuegang Securities Company Limited, which helps broaden the Company’s financial service business. Besides, in September 2016, the Company announced that the Group will complete an acquisition of Guangxi Wuzhou City Tong Bao Renewable Materials Limited which is beneficial for the company to carry out the environmental protection business.

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group, said: “We will grasp the opportunity of the launch of Shenzhen-Hong Kong Stock Connect by focusing on strengthening our financial businesses first, and then we will expand to the new environmental protection business sector.”

On the other hand, the Company issued an announcement on October 25, Tuesday. The Company and Guangdong Huaxing Bank Shenzhen Branch (“the Bank”) entered into a Strategic Cooperation Framework Agreement. According to the Strategic Cooperation Framework Agreement, the Company and the Bank agreed to establish a long-term and stable cooperation relationship for a period of three years. The total size of cooperation under the Strategic Cooperation Framework Agreement shall be RMB5 billion.

Dr. Bryan Lin, Xiaohui, said: “This strategic cooperation enables both parties to complement the strengths and resources of each other, which is beneficial for us to explore into different quality financing alternatives to facilitate the Group’s future business development.” He also believes that the cooperation can provide enough cash liquidity for the Company. Meanwhile, positioned as a conglomerate, Realord can also be supported by the cooperation in respect of enabling a more flourishing development of each business sector and the enhancement of revenue base.

Dr. Lin Xiaohui, Realord’s Chairman, introduced the Company’s latest business development to the participants

“Linking Shenzhen-Hong Kong Stock Connect” investor presentation attracted approximately 30 institutional investors, fund managers and media from Hong Kong and mainland China to join.

- End -

Realord and Guangdong Huaxing Bank Shenzhen Branch enters into a RMB5 billion strategic cooperation framework agreement

(October 26, 2016 – Shenzhen) Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK), is pleased to announce that the Company and Guangdong Huaxing Bank Co., Ltd., Shenzhen Branch (the “Bank”) have entered into a strategic cooperation framework agreement (the “Agreement”), with a total size of RMB5 billion, to partner in establishing a long-term and stable cooperation relationship for a period of three years.

Lin Xiaodong, Executive Director of Realord (First from left) and Liu Hong, Vice President of Guangdong Huaxing Bank Co., Ltd., Shenzhen Branch (Second from right) signed the Strategic Cooperation Framework Agreement

The strategic cooperation framework agreement signing ceremony was held at the headquarters of the Bank. Guo Zhihong, President of the Bank, Liu Hong, Vice President of the Bank, Liu Xuewei, General Manager of Strategic Customer Division 2 of the Bank, Wu Qibin, Assistant of General Manager of Corporate Banking Department of the Bank, Dr. Bryan Lin, Chairman of Realord, Lin Xiaodong, Executive Director of Realord, Liu Zixia, Vice General Manager of Shenzhen Realord Commercial Holdings Limited participated the signing ceremony.

Dr. Bryan Lin, Xiaohui, Chairman of the Group, said, “Through this strategic cooperation, Realord and the Bank can achieve a win-win situation by complementing each other’s strengths and resources. Also, it enables Realord to explore various excellent funding options to facilitate the Group’s future business development.”

During the meeting, Mr. Guo Zhihong and Dr. Bryan Lin fully affirmed the long-term mutual cooperation and looked forward to the future development of both parties. Mr. Guo said, “The relationship between the Bank and Realord is beyond significant strategic partners, while the best friends forever to seek for more comprehensive collaborations in the future under this Agreement.

Pursuant to the Agreement, the Company agreed to identify and provide cooperation opportunities in respect of the financing services for, among other things, property projects, industrial projects, mergers and acquisitions, credit facilities and cross-border financing activities of the Group; and the Bank agreed to provide the relevant financing services for such proposed projects, including but not limited to asset management and integrated financial services. Further definitive agreements for specific types of cooperation will be entered into between the Company and the Bank, and will be in compliance with the relevant laws and regulations. The total size of cooperation under the Agreement shall be RMB5 billion.

The Bank is a branch of Guangdong Huaxing Bank Co., Ltd., which is a commercial bank with the operation headquarters located in Guangzhou. It is principally engaged in a wide range of banking services approved by the China Banking Regulatory Commission, including deposits, loans, domestic and international settlements, acceptance and discounting of bills, agency services for issuance, underwriting, redemption, sale and purchase of bonds, foreign exchanges, insurance services, provision of facilities and guarantees and sales of fund. It is experienced in asset disposal and reorganization, investment banking and asset management. According to the annual report obtained from the official website of Guangdong Huaxing Bank Co., Ltd., the assets held by Guangdong Huaxing Bank Co., Ltd. exceeded RMB100 billion as at 31 December 2015.

Group photo: (From the left) Liu Zixia, Vice General Manager of Shenzhen Realord Commercial Holdings Limited, Lin Xiaodong, Executive Director of Realord, Dr. Bryan Lin, Chairman of Realord, Guo Zhihong, President of Guangdong Huaxing Bank Co., Ltd., Shenzhen Branch, Liu Hong, Vice President of Guangdong Huaxing Bank Co., Ltd., Shenzhen Branch, Liu Xuewei, General Manager of Strategic Customer Division 2 of Guangdong Huaxing Bank Co., Ltd., Shenzhen Branch, Wu Qibin, Assistant of General Manager of Corporate Banking department of Guangdong Huaxing Bank Co., Ltd., Shenzhen Branch

- End -

Realord Chairman Dr. Lin Xiaohui Wins Asian Chinese Leadership Award

(September 27, 2016 - Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK), is pleased to announce that Dr. Lin Xiaohui, Chairman of the Group has won an “Asian Chinese Leadership Award”.

Dr. Bryan Lin, Xiaohui, Chairman of the Group, said: “Being supported by the organizer and judging panel I am so honored to win this award. Let me take this chance to express my gratitude to all of the staff, clients, partners, shareholders of the Group and all social communities for their long-term support.”

Dr. Bryan Lin (left) Chairman of the Group and Prof. Kurt Wüthrich (right), an owner of The Nobel Prize in Chemistry in 2002

Dr. Bryan Lin was interviewed by the organizers to express his feelings after being awarded

Realord Group Chairman Dr. Bryan Lin (left), and Chief Executive Officer Madam Su Jiaohua (right)

“Nobel Laureate Series: Social Caring Pledge Scheme cum Asian Chinese Leadership Award Presentation Ceremony”, jointly organized by Social Enterprise Research Institute and Asian College of Knowledge Management, was held at Kowloon Shangri-La Hotel. Around 300 politicians and business leaders attended to this ceremony.

It aims to commend Chinese business leaders from all social communities for their contributions and achievements to Asia’s society, culture and economy. After judging panel’s strict examination and approval, all winners will be invited to participate the award ceremony and allocated to a collection “Asian Chinese Leaders” which is co-published by Asian College of Knowledge Management, The Open University of Hong Kong and Hong Kong Economic Times. There are total 36 owners of Asian Chinese Leadship Award. Dr. Bryan Lin and 10 of the owners are classified as the group of corporate.

For more details of Asian Chinese Leadership Award, please refer to:

http://www.ackm.hk/whoswho/leader_files_v1.php?id=306

- End -

Realord Group Achieves Turnaround in profit for 2016 Interim Results

Realord Group Holdings Limited (“Realord” or the “Company,” together with its subsidiaries collectively known as the “Group,” stock code: 1196.HK) is pleased to announce its unaudited interim results for the six months ended 30 June 2016 (the “Period”). The Group’s results achieved turnaround from loss of approximately HK$9.9 million for the last corresponding period to profit of approximately HK$81.7 million for the Period.

2016 Interim Results

(HK$’000)

For the six months ended 30 June

Changes (%)

2016

2015

Turnover

92,844

77,335

+20.1%

Gross profit margin

44.9%

41.3%

+3.6%

Profit/(Loss)

81,689

(9,873)

From loss to profit

Profit/(Loss) attributable to the equity holders

81,689

(10,085)

From loss to profit

Profit/(Loss) per share(HK Cent)

7.08

(1.03)

N/A

*During the period, as a result of the completion of the acquisition of the properties situated at Qiankeng Industrial Zone, Fumin Community, Guanlan Town, Baoan District, Shenzhen, the PRC, figures for the last corresponding period were restated. accordingly.

During the Period, the Group recorded a turnover of approximately HK$92.8 million, representing an increase by 20.1% year-on-year (“YoY”). The increase in the turnover of the Group was primarily due to the increase in the turnover from the motor vehicle parts segment, the financial services segment and property investment segment.

Gross profit margin of the Group increased from approximately 41.3% for the last corresponding period to approximately 44.9%, which was due to the increase in revenue from the financial services segment and property investment segment, which comprised service income, margin interest income and rental income. During the period, the results achieved turnaround from loss to profit, and recorded approximately HK$81.7 million of profit. The profit per share was HK7.08 cents.

The increase in profit attributable to the equity holders was mainly due to the fair value gain on investment properties amounted to approximately HK$176 million, which was partly offset by the related deferred taxation of the fair value gain of approximately HK$84.9 million and also the increase in corporate expenses.

Business review

During the Period, the motor vehicle parts segment recorded a revenue of approximately HK$38.8 million, representing 41.8% of the total revenue of the Group. The segment revenue noted a significant increase by 73.2% YoY. The profit from this segment wasapproximately HK$0.9 million in the last corresponding period, and reached HK$1.7 million during the period.

During the period, the commercial printing segment recorded a revenue of approximately HK$38.4 million, representing 41.4% of the total revenue of the Group. There was a slight increase in segment revenue of 3.6% as compared to that in the last corresponding period.

In terms of the Property Investment Segment, in June 2016, the Group completed the acquisition of the properties situated at Qiankeng Industrial Zone, Fumin Community, Guanlan Town, Baoan District, Shenzhen, the PRC, which is a paramount step of the Group to evolve the real estate development business. The Property Investment Segment recorded a revenue of approximately HK$5.9 million during the period, representing 5.9% of the total revenue of the Group. Due to the increase of fair value gain on investment properties, the profit from this segment increased drastically to approximately HK$179.1 million during the period.

The Financial Service Segment recorded a revenue of approximately HK$5.3 million during the period, representing 5.7% of the total revenue of the Group. Besides, the Group had entered into an agreement with 5 other joint venture parties to set up a JV securities company to carry out securities businesses in the PRC, which can help the Group to expand its securities services business and to enable the Group to exchange its business network and relationship in the PRC, and hence to gain a foothold in the PRC market.

The Hangtag Segment recorded a revenue of approximately HK$4.8 million during the period, representing 5.2% of the total revenue of the Group. The segment revenue remained in similar level as the last corresponding period.

Outlook

The operating environment of the commercial printing and hangtag businesses will continue to be competitive in the coming years. The Group shall strengthen its business development team to achieve sales growth and increase market share. The Group is in the process to set up the PRC operations of motor vehicle parts segment in Guangzhou. We expect that the PRC operations will effectively contribute to the business expansion of the sales and distribution of motor vehicle parts business.

The Group is in the process to develop the financial services business, which would provide financial services including securities brokerage, margin financing, money lending and financial leasing services. With the upcoming launch of the Shenzhen-Hong Kong Stock Connect Scheme, the preferential government policies and the establishment of the joint venture(i.e. “Yuegang Securities Company Ltd”), we believe the Group would sustain a long term growth in the financial services business.

Looking forward, the Group will strike to explore for any potential real estate development or property investment opportunities. For the purpose of sustaining long term growth, we will also keep on exploring all potential opportunity to develop its businesses.

- End -