Press Release

Realord Group Announces 2018 Interim Results Profit Surges approximately 3 Times with Total Assets over HK$10 Billion Acquisition of Guanlan and Guangming Properties Broadens Property Portfolio Exploration of Environmental Protection Business Market

Results Highlights

The completed acquisition of “Guanlan Property” and “Guangming Property” in Shenzhen broadens the Group's property portfolio and the rental income will be expectedly generated in 2H2018

Changing the land use of the two owned industrial properties in Guanlan Longhua District, Shenzhen, will enhance and maximize the property value.

In line with the new national environmental protection policies, exploration in the Southeast Asia’s environmental protection business market will increase flexibility in the future

2018 Interim Results

(HK$’000)

For the six months

ended 30 June

Changes (%)

2018

2017

Revenue (Turnover)

220,308

216,233

+1.9%

Gross Profit

61,468

52,280

+17.6%

Profit before Tax

504,265

129,486

+289.4%

Profit/(Loss)

347,216

87,091

+298.6%

Profit/(Loss) Attributable to The Equity Holders

343,992

84,273

+308.2%

Earnings Per Share (HK Cents)

27.21

7.33

+271.2%

As at

30/6/2018

As at

31/12/2017

Cash & Cash Equivalent

218,101

61,477

+254.8%

Total Assets

10,303,698

2,175,492

+373.6%

Total Equity

2,499,300

1,103,998

+126.4%

(August 28, 2018 - Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group” , stock code: 1196.HK) is pleased to announce its unaudited interim results for the six months ended 30 June 2018 (the “Period”). The Group’s results recorded a surge in profit before tax by 289.4% to approximately HK$504.3 million and profit by 298.6 % to approximately HK$347.2 million for the Period.

During the Period, the Group recorded a revenue of approximately HK$220.3 million, an increase of 1.9% when compared with the same period last year. The increase was mainly due to increase in revenue of Motor Vehicle Parts Segment and Commercial Printing Segment. Subsequent to the Group tightened its credit control policy and put more effort in recovering overdue trade receivables in 2017, the Group resume its sales of motor vehicle parts back to normal, during the Period under review. As a result, Motor Vehicle Parts Segment recorded a huge increase in revenue by approximately 140.4% Year over Year (“YoY”) to HK$46.5 million. The basic earnings per share was HK27.21 cents.

The Group recorded a profit of HK$347.2 million, representing a significant increase by 298.6% YoY. The increase in profit by approximately HK$260.1 million was primarily attributable to fair value gains on investment properties of approximately HK$455.5 million, as a result of the Group broadening the property investment portfolio, which were enhanced after acquisition of Realord Investment Limited through acquisition of Realord Ventures Limited and Manureen Ventures Limited in April 2018 and the exchange gain of HK$182.1 million recognized during the Period under review.

Business review

The Environmental Protection Segment contributed a revenue of HK$113.8 million, representing 51.6% of the Group’s total revenue during the period under review. The segment recorded an operating profit of HK$11.1 million, representing an increase of 40.2% as compared to that of the last corresponding period. Based on the acquisition agreements in which the Group has acquired 60% of the issued share capital of Realord Environmental Protection, 1,750,000 consideration shares shall be allotted and issued by the Company to the vendor, Fortune Victory Asia Corporation, as part of the consideration if the qualified profit of Realord Environmental Protection for the financial year ended 31 December 2017 was not less than HK$35,000,000. The qualified profit of Realord Environmental Protection for the year ended 31 December 2017 amounted to approximately HK$46,179,000. Accordingly, the target profit has been fulfilled and the relevant consideration shares were allotted and issued to the vendor in June 2018.

The Motor Vehicle Parts Segment generated a revenue of HK$46.4 million during the period under review, representing 21.1 % of the total revenue of the Group. This segment recorded an increase in revenue by 140.4% as compared to HK$19.3million in the last corresponding period. The segment derived a profit of HK$76,000 during the period under review as compared to a profit of HK$138,000 in the last corresponding period.

The Commercial Printing Segment contributed a revenue of HK$44.9 million, representing 20.4% of the Group’s total revenue during the period under review. There was an increase in revenue by 15.4% as compared to the last corresponding period. However, due to the increase in the operation cost, the segment merely generated an operating profit of HK$2.1 million for the reporting period as compared to the operating profit of HK$380,000 for the last corresponding period.

The Property Investment Segment generated a revenue of HK$9.8 million, representing 4.4% of the total revenue of the Group. The revenue from this segment slightly increased by 7.7% when compared with the same period last year. The operating profit from this segment increased substantially from HK$150.8 million in the last corresponding period to HK$353.7 million during the period under review. The increase was mainly due to the increased fair value gains on investment properties recorded during the period under review amounted to approximately HK$455.5 million.

The Financial Services Segment generated a revenue of approximately HK$5.0 million, representing 2.3% of the total revenue of the Group during the period under review. The revenue of this segment remained stable. The segment recorded an operating profit of approximately HK$412,000 for the reporting period

The Hangtag Segment generated a revenue of approximately HK$498,000, representing 0.2% of the Group’s total revenue. The segment revenue decreased by 68.8% from the last corresponding period of approximately HK$1.6 million for the period under review. The operating loss derived from this segment was minimal during the period under review and the last corresponding period.

Outlook

During these years, the Group has always been committed to improving the business of all segments in order to achieve diversified business development. The Group has been actively exploring property investment business. In April 2018, the Group has finished the acquisition of Guanlan Property and Guangming Property, significantly enhancing the property portfolio of the Group. It is expected that the Guanlan Property and Guangming Property will generate rental income in the second half of 2018 and bring potential capital gain for the Group. The Group is optimistic about the prospects of the property investment business. Going forward, the Group will strive to identify properties with investment value and broaden the Group's property portfolio.

In May 2017, the Group submitted the applications to Shenzhen Longhua District Urban Renewal Bureau for changing the land use of two owned industrial properties in Longhua District, Shenzhen, namely the “Zhangkengjing industrial property” and “Qiankeng industrial property”, and another “Zhangkengjing industrial land” of which the development right was granted from Shenzhen Zhangkengjing Joint Stock Company to the Group. According to the applications, the land use of two Zhangkengjing industrial properties are planned to change to residential apartments and office use, while the Qiankeng property will be changed for public housing and residential use. It is expected that approval for the applications will be granted in the second half of 2018, subject to government schedules, and thereafter the redevelopment works will commence.

For the aspect of Environmental Protection Segment, as a result of new relevant environmental protection regulations released in the PRC to impose further requirements on importing scrap materials during the period under review, the Group plans to develop a processing plant in Southeast Asia for sourcing and dismantling scrap material from the originate country of scrap material in order to enhance the Group’s ability and flexibility to fulfill the new relevant environmental protection regulations. Hence, the Group will adjust the schedule to develop a processing plant for recycling and production of copper and aluminum ingots in Wuzhou Import Renewable Resources Processing Park located in Wuzhou, Guangxi Province, the PRC. In the future, the Group will examine the recent development of the environmental protection industry in the PRC, and commence the construction of the PRC Processing Plant in due course. It is expected that the construction of the PRC Processing Plant will commence in the first quarter of 2019.

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group expresses “The acquisition of Realord Villas and Realord Science & Technology Park completed in April 2018 enriches the Group’s property portfolio and income source. As the residents are moving in Realord Villas’ residential flats (also known as ‘Enterprise Talents Indemnificatory Housing Units’) allocated by Shenzhen Futian District Housing and Construction Bureau, the operating leases of the mall, retail shops and parking lots are expected to be motivated, thus generating rental income in the second half of the year. It is anticipated the open of Guangzhou-Shenzhen-Hong Kong Express Rail Link and the surrounding railways, transportation facilities, and the commercial and residential buildings successively will be constructed in Guangming District, Shenzhen in which the commercial properties development will also be motivated. Realord Science & Technology Park, in there, will be benefited. As the projects in the Guangdong-Guangxi Interprovincial Pilot Cooperation Special Zone and implementation of new environmental protection regulations have been commenced that bring opportunities for the Group’s environment protection business and enlighten the new idea in exploring the Southeast Asia market. Looking ahead, Realord Group will be devoted to maintaining steady growth of each segment in order to strive for the greatest return for investors and shareholders.”

Deputy Director of the United Front Work Department of the Shenzhen Municipal Party Committee, Party Secretary of Shenzhen Municipal Federation of Industry and Commerce & General Chamber of Commerce Cai Li visited Realord Group

On the afternoon of August 24th 2018, a Signing Ceremony of Cooperation Memorandum between Shenzhen Federation of Industry and Commerce & General Chamber of Commerce and the Municipal Taxation Bureau, and also the announcement meeting of enterprises’ preferential policies were held in National Taxation Complex Building. After the meeting, Deputy Director of the United Front Work Department of the Shenzhen Municipal Party Committee, Party Secretary of Shenzhen Municipal Federation of Industry and Commerce & General Chamber of Commerce Cai Li, Deputy Inspector Gu Ping, Deputy Director of the United Front Work Department of the Shenzhen Futian District Municipal Party Committee, Party Secretary of the Shenzhen Futian District Federation of Industry and Commerce & General Chamber of Commerce Shi Youjun visited Realord Group’s Shenzhen office. Dr. Bryan Lin, Xiaohui, the Chairman of Realord Group introduced the company's latest information to those visitors.

Secretary Cai Li fully affirmed Dr. Lin's appointment as the new Chairman of the Futian District Federation of Industry and Commerce, Shenzhen Futian District Federation of Industry and Commerce & General Chamber of Commerce, and praised Realord Group as an "excellent exemplar of the non-public enterprises" which is fully in compliance with "Strong in Ideological Politics, industry representation, ability in politics participation and Good social reputation”.

Cai believes that the All-China Federation of Industry and Commerce (ACFIC) is a complete and sound national organization. It is a bridge among the government and non-public economic enterprises and non-public economic people. It has also been committed to negotiating and strengthening team building. She encouraged Dr. Lin to communicate and participate as both a representative of entrepreneurs and the chairman of the District Federation of Industry and Commerce, giving opinions and suggestions to the ACFIC more directly, so as to implement ACFIC’s functions thoroughly including giving political guidance and economic service, appeal, rights and interests, integrity and self-discipline, and participation in social governance.

The establishment and business transformation of Realord Group is at the same time accompanied with the transformation and development of Shenzhen City, which is full of feelings and social responsibility. The enterprises in Futian District are the most representative. The quality of the civil servants and the teammate of Shenzhen Federation of Industry and Commerce in the district is also at a high level in the city. Secretary Cai Li hopes that the Futian District Federation of Industry and Commerce will create the Shenzhen Federation of Industry and Commerce best samples and highlights under the leadership of Chairman Dr. Bryan Lin.

Realord Group Chairman Dr. Bryan Lin expressed his sincere gratitude to Secretary Cai Li for giving Realord Group positive comments. He said he will live up Shenzhen Federation of Industry and Commerce ’s expectation and won’t forget the initial intentions, and will lead more members (companies) being adopted with a new model of harmony and integrity relationship between corporates and politics, promoting Futian as a leading district as the core engine of Guangdong-Hong Kong-Macao Greater Bay Area.

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group has been elected as the Chairman of Shenzhen Futian District General Chamber of Commerce

On the 7nd August 2017, Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce that Dr. Bryan Lin, Xiaohui, Chairman of Realord Group has been elected as the Chairman of Shenzhen Futian District Federation of Industry and Commerce & General Chamber of Commerce (SZFTFIC).

The fourth committee member meeting of the Shenzhen Futian District General Chamber of Commerce and the fourth Executive Committee meeting were held at the Shenzhen Convention and Exhibition Centre. A new session of fourth committee members was elected. Realord Group Chairman Dr. Bryan Lin was elected as Chairman of Fourth Executive Committee of Shenzhen Futian District Federation of Industry and Commerce & General Chamber of Commerce.

Cai Li, Deputy Director of the United Front Work Department of the Shenzhen Municipal Party Committee, Party Secretary of the Municipal Federation of Industry and Commerce, Liu Junlin, Member of the Standing Committee of the Futian District Committee and Minister of the United Front Work Department, the Leaders SZFIC and 300 Futian-based entrepreneurs attended the meeting.

Dr. Bryan Lin said, "Thanks to the support from the members of political and commercial sectors. It's my honor to be elected as the Chairman of Futian District SZFIC.

In the future, we will lead more members (companies) being adopted with a new model of harmony and integrity relationsip between corporates and politics, guiding the members to actively participate under the development of "Belt and Road", promoting Futian as a leading district of modern industry in a world class bay area, forging Shenzhen-Hong Kong Science and Technology Innovation Special Cooperation Zone as the core engine of Guangdong-Hong Kong-Macao Greater Bay Area.

About Shenzhen General Chamber of Commerce

The Shenzhen General Chamber of Commerce of Commerce is a mass organization of people's organizations and chamber of commerce organized by the Shenzhen business community led by the PRC government. It is a bridge between the party and the government in connection with the non-public sector of the economy and an aide in the government's management of the non-public sector of the economy. Shenzhen General Chamber of Commerce members include organization members, corporate members and individual members. Among them, the organization members include private enterprise associations and more than thirty industry associations. Grass-roots organizations include districts, sub-district district chambers of commerce and trade associations. The Shenzhen General Chamber of Commerce Members are characterized as flourishing talent lineup, powerful, full of vitality and fast development. As of September 2015, more than 20,000 SGFIC members have been registered.

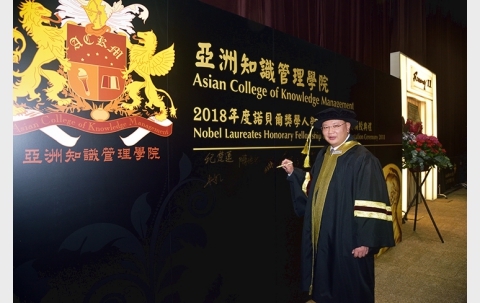

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group, was awarded the Fellowship of Asian College of Knowledge Management (ACKM)

(July 21, 2018 – Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce that Dr. Bryan Lin, Xiaohui, Chairman of Realord Group, was awarded as Fellowship of Asian College of Knowledge Management (FACKM).

ACKM's "Nobel Laureates Honorary Fellowship & Awards Presentation Ceremony 2018" was held on 21st July at the AsiaWorld-Expo in Hong Kong. Dr. Bernard Chan Pak-li, Vice Secretary for Commerce and Economic Development Hong Kong Special Administrative Region Government, Dr. Ko Wing Man, GBS, JP, member of the National Committee of the Chinese People's Political Consultative Conference, Professor Arthur Hamilton, Honorary Dean of the Canadian Chartered Institute of Business Administration, and Professor Richard Olesen, Honorary Supervisor of the University of Lincoln, served as the officiating guests. A total of 88 elites from different industry and 5 companies were awarded. Dr. Bryan Lin, Xiaohui, Chairman of the Group, was awarded as FACKM.

Dr. Lin is a Shenzhen and Hong Kong entrepreneur and philanthropist who supports Shenzhen-Hong Kong medical development. He is also a Committee Member of the Shenzhen CPPCC, Standing Committee Member of the Shenzhen Futian District CPPCC, the Honorary President of the HKU Foundation and the Chairman of the Bryan Lin Foundation. Over the years, Dr. Lin has been concerned about the people's livelihood in China and Hong Kong, and is enthusiastic about charities and social construction. In 2012, he cooperated with the Shenzhen Futian District Government by providing a land to construct talents housing project “Realord Villas” to meet the housing needs of the talents in Futian District, Shenzhen. Dr. Lin has donated a total of HK$15 million to the Faculty of Medicine of The University of Hong Kong to support children's cardiology research. In recognition of his outstanding performance and the contribution to charities, Dr. Lin was awarded the “Shenzhen Outstanding Entrepreneur” (2005), “2008's Top 10 Economic Figures in Guangdong Province”(nomination award), “14th World Outstanding Chinese”(2015) and “Asian Chinese Leader” (2016). He also received an Honorary Doctorate Degree of Business Administration issued by Sabi University, France (2015). His achievements have been highly recognized by the society.

Dr. Bryan Lin, Chairman of Realord Group Holdings Limited (Right) & Dr. Ko Wing Man, GBS, JP, member of the National Committee of the Chinese People's Political Consultative Conference (Left)

Dr. Bryan Lin, Chairman of Realord Group Holdings Limited (Middle), Professor Arthur Hamilton (Right), Honorary Dean of the Canadian Chartered Institute of Business Administration, and Professor Richard Olesen (Left) , Honorary Supervisor of the University of Lincoln

Dr. Bryan Lin, Chairman of Realord Group Holdings Limited (Left) & Ms Suki, Su, Chief Executive Officer of Realord Group Holdings Limited (Right)

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group expresses: “Thanks to the recognition and support from the Judging Committee of the Asian College of Knowledge Management, I am happy to be conferred such an honor with other scholars and entrepreneurs at the stage. Also, I would like to take this opportunity to thank the colleagues of Realord Group and friends who always support me. Realord Group and I have been attaching great importance in corporate social responsibilities. In the future, I will continue to push myself leading the Group to support various charitable activities, striving to create the greatest value for the society.”

- END -

About the Asian College of Knowledge Management and the Nobel Laureate Honorary Fellowship Ceremony & Awards Presentation Ceremony

ACKM is a comprehensive platform that provides a professional learning, networking, research and collaboration opportunity for government agencies, academic professionals, entrepreneurs and knowledge management in Asia. It is also the first professional institution to develop a series of knowledge management certification standards. The College is committed to nurturing future leaders and promoting communities to build sustainable businesses. Through the election of academicians, it is hoped outstanding individuals with deep social contribution and influence can be recognized, and establish a model for different industries.

Nobel Laureate Honorary Fellowship Ceremony & Awards Presentation Ceremony has been held in Hong Kong for three consecutive years, whilst this is the 7th year. The attendees of the ceremony were social leaders and outstanding enterprises from different sectors. More than a thousand celebrities and guests attended. Through this opportunity, it is hoped that the visibility and service quality of Asian products can be enhanced. Thus, enhance the recognition of Asian companies and entrepreneurs from all walks of life, overseas businesses and consumers.

Celebrating the 21st anniversary of Hong Kong returned to the PRC: The "Dream of Greater Bay Area" sponsored by Realord Group was successfully held

(July 1, 2018 - Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce the "Guangdong, Hong Kong, Macau Youths celebrate the 21st Annversity of Hong Kong Return to PRC Evening Party" was held successfully at the Hong Kong Coliseum organized by Hong Kong Celebrations Committee, Hong Kong Arts Performance Development Centre and Guangdong Youth Federation. Dr. Bryan Lin Xiaohui, chairman of the Realord Group Holdings Limited, as one of the event's sponsors, was invited as a guest to the party.

The officiating guests at the party included officials from the Central People's Government Liaison Office in the Hong Kong Special Administrative Region and the Hong Kong Special Administrative Region. The theme of this event was "Hong Kong, Macau, and the Greater Bay Area", that establishs a foothold in Hong Kong and cover the Greater Bay Area of Guangdong, Hong Kong, and Macao, and to promote the exchange of more outstanding cultural and artistic talents among the cities. The significance of this event is passed on to more youth groups, to increase their mutual understandings, to jointly build their homes, to integrate into the overall development of the country’s future, and to create a world-class urban agglomeration. In addition, the evening party invited youths from Guangzhou, Foshan, Zhaoqing, Jiangmen, Zhuhai, Zhongshan, Shenzhen, Dongguan and Huizhou, as well as Hong Kong and Macau SAR’s youth performance teams, with local famous singers having performances at the same stage.

Dr. Bryan Lin Xiaohui, chairman of the Realord Group Holdings Limited, said: “We are fortunate on behalf of the Group to participate this celebration. Today is the first anniversary of the official signing of the Guangdong-Hong Kong-Macao Bay Area Cooperation Framework Agreement, and also the 97th anniversary of the founding of the Chinese Communist Party. The development of the Bay Area is now in full swing, and it would bring new opportunities to Greater Bay Area Cities and our company, and we look forward to working together with young people to witness the flourishing prosperity of the Greater Bay Area, and we hope that Greater Bay Area Youths could grasp this opportunity in the Greater Bay Area to find and create their own careers, making the greatest contribution to society and the country."

Realord Chairman Attends 2018 Sai Kung Dragon Boat Gala

Hosted by Sai Kung District Dragon Boat Race Preparation Committee and sponsored by the Sai Kung District Council, “2018 Sai Kung Dragon Boat Gala” was held in Sai Kung Ferry. Dr. Bryan Lin Xiaohui, Chairman of Realord Group Holdings Limited was invited to the gala and the chief executive officer Ms. Suki Su Jiaohua accompanied to attend the activity.

The officiating guests included the Secretary for Justice, Hong Kong Special Administrative Region, Ms. Teresa Cheng, the Sai Kung District Council Chairman Dr Ng Sifuk, The Sai Kung District Office Sai Kung District Officer, Mr. Chiu Yinwah, JP, Chairman of the Preparatory Committee for Dragon Boat Races in Sai Kung District, Mr. Lau Wai Kin, Chairman of the Preparatory Committee for the Dragon Boat Race Preparing Committee in Saigon District and Member of the Standing Committee of Shenzhen Municipal Committee Mr. Li Shengpo, Chairman of Sai Kung District Rural Committee Mr. Wong Shuisheng, Chairman of the Hangkou Rural Committee and Deputy Chairman of the Sai Kung District Council Mr. Shing Han Keung, Chairman of Sai Kung District Fight Crime Committee Mr. Chan Kuen Kwan, The Chairman of the Dragon Boat Race Preparing Committee in Sai Kung District and the Prime Minister of Sai Kung Association Mr. Lee Fuk Hong, Chairman of the Preparatory Committee for Dragon Boat Races in Sai Kung District Mr. Cheung Tian Sung, Chairman of Sai Kung District Sports Association, The Chief Consultant of the Dragon Boat Race Preparatory Meeting Preparatory Mr. Mak Hing Kwan, The Chief Consultant of the Dragon Boat Race Preparatory Meeting Preparatory Committee of Sai Kung District, Mr. Sun Qilie, BBS,JP, Member of the Standing Committee of the Shenzhen Municipal Committee of the CPPCC and Director of the Hong Kong, Macao and Taiwan Overseas Chinese Affairs and Foreign Affairs Committee Mr. Pan Jiadong.

Dr. Bryan Lin Xiaohui, Chairman of Realord Group, said that he was honor to be invited there to see such exciting Dragon Boats Competition, not only to promote the traditional Chinese culture, but also the team spirit and sportmanship, that is definitely worth supporting. Thanks to the arrangement by the hosts and all the races were succesfully held under a good weather. I look forward to the next year's gala and we wish you all the best in the Duanwu Festival!

Female/Male Youths Invitational Dragon Boat Final Race - "Realord Group Cup" Championship

Female Youth Dragon Boat Final Race - "Realord Manureen Cup" Championship

Environmental Protection Business Fulfils FY2017 Target Profit with 30% Exceedance Realord Will Allot and Issue 1.75 Million New Shares

(May 31, 2018 - Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce the Company’s environmental protection business acquired in 2017 had remarkable performance, recording qualified profit of approximately HK$46,179,000, which has achieved and over the Target Profit of HK$35 million stated in the acquisition agreement, with 30% or approximately HK$11 million exceedance. The Company will allot and issue 1.75 million consideration shares to Fortune Victory Asia Corporation (“Vendor”) according to the acquisition agreement.

In accordance with the terms of the acquisition agreement, the purchaser and the Vendor agreed that the Company shall as part of the consideration allot and issue 1,750,000 consideration shares to the Vendor or its nominee(s) within 10 business days that the qualified profit of the target group, being the consolidated net profit after tax of the target group after excluding any (i) gain on bargain purchase; and (ii) revaluation gains or losses of properties and the associated deferred tax charged to the statement of profit or loss, for the financial year ended 31 December 2017 was not less than HK$35,000,000. As the qualified profit of environmental protection business recorded HK$46,179,000, fulfilling the qualified profit target, the Company will allot and issue 1,750,000 Consideration Shares to the Vendor on or about 8 June 2018.

Environmental protection segment contributed most of the revenue of the Group in 2017, with revenue recorded approximately HK$572 million, accounting for 75% of the total revenue and operation profit approximately HK$52.3 million. In addition, the Group plans to develop a processing plant for recycling and production of copper and aluminum ingots (the “Processing Plant”) in Wuzhou Import Renewable Resources Processing Park located in Wuzhou, Guangxi Province, the PRC, with target annual production capacity of 100,000 tonnes. The Group is planning to acquire land for the construction of the Processing Plant. It is expected that the land acquisition will be completed in mid- 2018 and the construction will commence in the third quarter of 2018. The construction of the Processing Plant will become a driver for a long-term growth of the Group’s business, bringing more revenue for environmental protection business.

The Company, as purchaser, acquired 60% of the issued share capital of Realord Environment Protection (previously known as Top Eagle International Trading Limited) in consideration of HK$25 million in cash and 5 million consideration shares (each consideration share equal to HK$7, with total value of HK$35 million), equivalent to a total consideration of HK$60 million. In accordance to the transaction agreement, if Realord Environment Protection fulfills the target profit of HK$15 million by 2017, Vendor will be allotted and issued 750,000 consideration shares; If fulfilling the target profit of HK$35 million by 2018, Vendor will be allotted and issued 1.75 million consideration shares; If fulfilling the target profit of HK$50 million by 2019, Vendor will be allotted and issued 2.5 million consideration shares; If Realord Environment Protection cannot achieve the target profit in the financial year above, Realord will not need to allot and issue relevant consideration shares.

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group expresses “The Guangxi Environmetal Protection Business was acquired less than two years that the first and the second expected profit targets have been fulfilled with exeedcance which flourishes the revenue and cash flow of the Group, thus the Board has great confidence on the environmental protection investment prospect and will continue to seek for different investment opportunity to strike for better return for our shareholders.”

- End -

Realord Group & Greater Bay Area Industry Finance Discuss the Possibilities of Co-operating Financial Services and Urban Construction Development in the Greater Bay Area

(May 11, 2018 - Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce meeting with management of Greater Bay Area Industry Finance Investment Co. Ltd (“Bay Area Industry Finance” or “BAIF”) in discussion for future potential co-operation in Leasing & Financing and Property Development Business in Guangdong-Hong Kong-Macao Greater Bay Area.

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group met Bay Area Industry Finance’s Senior Vice President, Mr. Calvin Choi and Wu Haifeng, Associate President, Wang Xiaoxing, Investment Director, Mei Xuan and Board Office Deputy General Manager Dai Yibo. Both parties had detailed discussion of Leasing & Financing and Property Development Business. Through co-operation and mutual assistance in term of resources, a close bonding of co-operation is expected to be built.

Bay Area Industry Finance has showed interest in Realord’s property development and city renewal projects, especially last year the applications had been submitted to the government for changing land use of three owned industrial properties in Guanlan Longhua District to construct residential buildings in response to the Shenzhen Municipal’s City Renewal Plan, and believed that those projects might fit for the theme of “Bay Area City Development”, one of BAIF’s five business strategies, being potential for investment and cooperation, as well as benefiting urban development in the Greater Bay Area.

In addition, Bay Area Industry Finance currently plans to establish a joint venture of financing & leasing with registered capital RMB 1 billion in Nansha, Guangzhou, inviting Realord Group, a company incorporated overseas, to acquire 25% of the shares. It is believed that commencing financing & leasing business in Nansha is beneficial to the financial services of Guangdong-Hong Kong-Macao Greater Bay Area.

Manureen Financial Holdings Limited, a non-listed private company owned by Dr. Bryan Lin, Xiaohui, Chairman of Realord Group, has acquired Bay Area Industry Finance for the consideration of RMB 600 million. As a shareholder of Bay Area Industry Finance, Dr. Bryan Lin expresses “Realord Group plans property development and financial business in the Greater Bay Area. With the help of the vast advantage and resources of Bay Area Industry Finance, the Group will acquire multi-dimensional planning in the Greater Bay Area, facilitating infrastructure construction and financial investment in the Guangdong-Hong Kong-Macao Greater Bay Area and bring greater return for our shareholders. “

- END -

About Greater Bay Area Industry Finance Investment Co. Ltd

To assist the strategical planning of Guangdong-Hong Kong-Macao Greater Bay Area and respond to the summon for establishing the Greater Bay Area in 19th National Congress of the Communist Party of China, fulfilling the request of the Central Economic Work Conference in facilitating virtuous cycle in finance and macro economy, Greater Bay Area Industry Finance Investment Co. Ltd (“Bay Area Industry Finance”) is established under the initiation of Guangdong Federation Of Industry And Commerce and Guangdong General Chamber Of Commerce and financing of high quality listed companies and leading private companies in Hong Kong and China. The registered capital of the company is RMB 40 billion, with approval from State Administration for Industry and Commerce of the People's Republic of China and registration in Guangzhou. Operation headquarters are set up in Guangdong, Hong Kong and Macau respectively. Bay Area Industry Finance embraces “One Core Five Wings” as development strategy, with connection of industry and finance as core, and Bay Area industry investment, Bay Area city development, Bay Area financial services, Bay Area community development and Bay Area industry finance (foreign) as wings. With the management of a advantaging platform, Bay Area Industry Finance will facilitate resources and advantages mutual benefit between shareholders in financial services, industry upgrade, city development, technology innovation, environmental management, connection of military and civil sectors, development of culture and tourism and health care sectors, motivating high quality development of Guangdong-Hong Kong-Macao Greater Bay Area.