Press Release

Full Caring Foundation Executive Vice Chairman Yue Yi Visited Realord Group

On February 20, 2019, Executive Vice Chairman of Full Caring Foundation, former Vice Chairman and Vice President of Bank of China (Hong Kong) Mr. Yue Yi, Shenzhen CPPCC Member, Chairman of Taxi Drivers & Operators Association (“TDOA”) Huang Yifeng, the general secretary of TDOA Huang Daihai visited headquarter of Realord Group.

Mr Yue highly appreciated the efforts made by Realord Group, Dr. Bryan Lin Xiaohui and the staff in past 13 years, by adhering a spirit of the company “innovation and development, pursuit of excellence”.

Yue Yi was a one of the famous banker in China. In June 2008, he was awarded the “Chinese Retail Banker of the Year” by The Asian Banker. More Important, he left the management work from the bank and approaches the Hong Kong grassroots level, and now serves as the executive vice chairman of Full Caring Foundation, lending a hands to the grassroots in Hong Kong, precisely caring for the community, and exerting the unremitting efforts for the people's livelihood project.

Realord Chairman Dr. Bryan Lin wishes you a Happy Chinese New Year 2019

The Lunar Chinese New Year is coming soon, on behalf of Realord Group, I would like to express my warm greetings and festival wishes to all the colleagues and the one who cares about Realord Group!

This year, at the 40th anniversary of China's reform and opening up, it is also a fulfilling year for the Group. Led by the Chinese PRC government, thousands of dream achievers, including us and the Group, inspiring and encouraging each other, steadily moving forward!

This year is also the 13th year of the group's establishment, the fourth year of “Realord Group” listing on the Hong Kong Stock Exchange, and the second year of the Group becoming the eligible securities of Shenzhen-Hong Kong Stock Connect. The Group's integrated business model has been developed rapidly. Each of the financial indicators hits new high and our Group was ranked as 22nd of 150 in the Shenzhen-Hong Kong Stock Connect’s Fastest Growing Companies from “2018 Golden Wing Awards”, and then we received

“2018 Distinguished Listed Company” awarded by TVB Finance & Information Channel.

Thanks to Realord Staffs’ diligence and contributions, the above achievements were made and I am really appreciated for all the things that they have been doing for the Group. Thank you for their enthusiasm and efforts. Thank you all of you.

The future is full of opportunities and challenges. No matter how the international situation changes, our group will surely grasp the new opportunities under the new era, reviewing the situation, forging ahead, and of course not to forget the original intention and mission, so as to achieve our greatest "Realord Dream"!

Thank you all!

Realord Chairman Dr. Bryan Lin attends the opening ceremony of the "Greater Bay Area Homeland Development Fund"

The opening ceremony of the "Greater Bay Area Homeland Development Fund" and the "Greater Bay Area Homeland Youth Fund" was hosted on the Hong Kong Stock Exchange on 12th December. The Chief Executive of the Hong Kong Special Administrative Region Carrie Lam Cheng Yuet-ngor, the Commissioner of Office of the Commissioner of the Ministry of Foreign Affairs of the People's Republic of China in the Hong Kong Special Administrative Region, Xie Feng, the Deputy Director of the Central People's Government in the Hong Kong S.A.R, Qiu Hong, and the Deputy Director of the Central People's Government in the Hong Kong S.A.R, Chen Dong were invited to attend the activity. Dr. Bryan Lin Xiaohui, Chairman of Realord Group Holdings Limited, also known as the vice chairman of the funds, also attended the event.

Carrie Lam struck the “Gong” to launch the opening, and then gave her speech: "Guangdong, Hong Kong and Macau Greater Bay Area, through the complementary advantages of the 11 cities within the bay area, is dedicated to enhance its global competitiveness as the world-class Bay area, which is suitable for live, work and travel. The newly established funds aim to support the development of Hong Kong's science and technology, and to promote re-industrialization as well. Those objectives were coincided with the key works made by the government of Guangdong, Hong Kong and Macau. Also, the fund establishment is a big help for the youth who may encounter the difficulties such as studies, employment and startups in the Greater Bay Area.

Dr. Bryan Lin, Chairman of Realord Group said: "We are pleased to witness the unveiling of the "Greater Bay Area Homeland Development Fund" and the "Greater Bay Area Homeland Youth Fund" and we look forward to create a better quality of living homeland in the Greater Bay with the youth altogether.

Dr. Bryan Lin, Chairman of Realord Group Holdings Limited (right) & Mr. Calvin Choi, Board member and Senior Vice President of Greater Bay Area Investment Group (GBAIG) (left) are also the Vice Chairman of the Funds.

Realord Group Awarded as “Distinguished List Companies” in “2018 Listed Companies Distinguished Awards” by TVB Finance & Information Channel

(November 23, 2018 - Hong Kong) Realord Group Holdings Limited (“Realord Group” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce Realord Group was awarded “Distinguished List Companies” by TVB Finance & Information Channel. On behalf of Realord Group, Chairman Dr. Bryan Lin Xiaohui was invited to receive the trophy, and CEO Ms. Suki Su Jiaohua, Executive Director Mr. Trevor Lin Xiaodong and Chief Financial Officer and Company Secretary Chan Chu Kin accompanied to attend the ceremony.

Two awards namely “Distinguished Listed Companies” and “The Most Potential Listed Companies” have been set up in “2018 Listed Companies Distinguished Awards” first organized by TVB Finance & Information Channel to praise the Hong Kong Listed Companies with outstanding performances. Based on a reliable selection mechanism, with companies’ business stability, corporate governance, marketing activities, corporate social responsibility and investor relations reviewed and analyzed by different professional parties, the outstanding listed companies were selected. All 17 awarded listed companies are corporates with outstanding performance in market. The judging panels are the professionals including Mr. Henry Lai Hi Wing, Chairman of Hong Kong Institute of Directors, Mr. Kenny Tang Seng Hing, Chairman of the Hong Kong Institute of Financial Analysts and Professional Commentators Limited, Dr. Eva Chan Yiwah, Chairman of Hong Kong Investor Relations Association .

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group expresses “We are honored to receive the “Distinguished Listed Companies” Awards on behalf of Realord Group and have the opportunity to learn from different awarded listed companies with outstanding performance in different industries. We would like to thank the organizer and the judges for their recognition on the Group as well as to thank all the Realord staffs for their effort in all these years. Realord Group, with 13 years of achievement since its establishment, will uphold the spirit of “Innovative Development and the Pursuit of Excellence” to maintain better corporate governance so as to create the better value and return for shareholders and investors.”

Your browser does not support the video tag.

Realord Group Honored in the 2018 "Golden Wing Awards" as one of the Shenzhen-Hong Kong Stock Connect’s Fastest Growing Companies

(October 19, 2018 - Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce that Realord Group was recently honored and listed in the 2018 "Golden Wing Awards", Shenzhen-Hong Kong Stock Connect’s Fastest Growing Companies Ranking.

The 2018 “Golden Wing Awards” for the most valuable Hong Kong listed companies, hosted by the Securities Times, a mainstream financial media in capital market of China, was held at Four Seasons Hotel Shenzhen on October 19. Realord Group was honored and listed as the 22nd in the Hong Kong Stock Connect’s Fastest Growing Companies Ranking among 150 participating Hong Kong Stock Connect Companies, indicating that the business growth and profit capability of the Group were deeply recognized by the judges. Nominated Companies in Hong Kong Stock Connect’s Fastest Growing Companies Ranking were first selected according to the net profit compound ratio for the last three years and then decided by voting of professional judges and online voters. The award recognizes the top, highest quality companies listed on the Hong Kong Stock Connect, and aims to enhance the Company’s brand within both capital market of Hong Kong and China. The judges consist of experts in Hong Kong Stock Connect Companies, including Dr. Shen Minggao, Chief Economist of GF Securities, Mr. Hao Hong, Managing Director and Head of Research of BOCOM International etc.

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group expresses “We are greatly honored to be listed as the 22nd the 2018 "Golden Wing Awards", Hong Kong Stock Connect’s Fastest Growing Companies Ranking. The award signifies the judges’ recognition on the effort of the Group. We will be dedicated to developing different business segments and continue to strike for greatest return for our shareholders.”

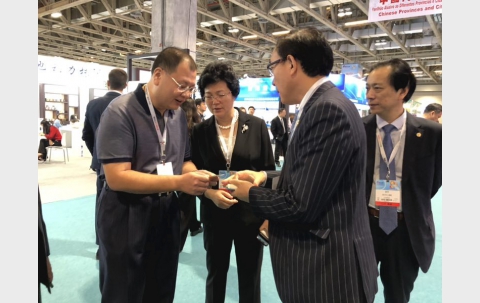

Realord Group Chairman Attends the 23rd MIF in Macau

The 23rd Macao International Trade and Investment Fair (MIF) kicked off on the 18th October, 2018 at the Venetian Macao Convention and Exhibition Center. The Chief Executive of the Macao S.A.R. Government, Chui Sai On, the Director of Liaison Office of the Central People’s Government in the Macao S.A.R. Zheng Xiaosong, Commissioner of the Ministry of Foreign Affairs of the People's Republic of China in the Macao Special Administrative Region Shen Beili and the Minister of Industry and Trade of Mozambique, La Jandra de Sossa hosted the opening ceremony.

Vice Chairman of the Shenzhen Municipal CPPCC, Chen Qianwen, Director of the Municipal Audit Bureau, Vice Minister of the United Front Work Department of the Municipal Party Committee, Party Secretary of the Municipal Federation of Industry and Commerce, Mr. Gu Ping, Deputy Inspector of the Municipal Federation of Industry and Commerce, Pan Jiadong, Director of the Hong Kong, Macao and Taiwan Overseas Chinese Affairs Committee of the CPPCC, Chairman of the Futian District Federation of Industry and Commerce Lin Xiaohui, Chairman of Realord Group were invited to participate in the opening ceremony of the Shenzhen’s exhibition area.

With the theme of “promoting cooperation and creating business opportunities”, and in addition to the exhibition areas for the provinces and cities in China, the countries along the “Belt and Road”, Portuguese-speaking countries and Europe, “Guangdong-Hong Kong-Macao Greater Bay Area Business Zone”, "Guizhou Congjiang County" Exhibition Areas were first displayed this year. Among them, the "Shenzhen Pavilion" exhibited by Shenzhen International Cultural Industry Fair Co., LTD.

Dr. Bryan Lin Xiaohui, Chairman of Realord Group Holdings Limited, said: "Thanks to the arrangement made by Shenzhen Federation of Industry and Commerce, and i am honor be invited by Shenzhen International Cultural Industry Fair Co., LTD to participate in the 23rd MIF and Shenzhen Pavilion’s opening ceremony. It was an opportunity for us to bridge communication gaps and build trust among the entrepreneurs and chambers of commerce in Macau and Zhuhai. As Hong Kong–Zhuhai–Macau Bridge will be open soon, MIF brings more development opportunities to enterprises and organizations in Shenzhen, Hong Kong and Macao, and even cities in Guangdong-Hong Kong-Macao Greater Bay Area, and also creates a broader space for cooperation."

Chairman and Chief Executive Officer of Realord Group Exercised Share Option Respectively to Increase Shareholding of 2.16 Million Shares in Total

(October 8, 2018 - Hong Kong) Realord Group Holdings Limited (“Realord” or the “Company”, together with its subsidiaries collectively known as the “Group”, stock code: 1196.HK) is pleased to announce that Dr. Bryan Lin, Xiaohui, Chairman of Realord Group and Suki Su, Jiaohua, Chief Executive Officer of Realord Group, exercised share option granted by The Company on 20 May 2015 respectively. Each of them acquired 1.08 million shares, a total of 2.16 million shares, at exercise price of HK$4.11 per share. The shareholding of Lin and Su in Realord will increase to 1,073,160,000 shares after acquisition, accounting for 74.75% of total issued shares.

Other directors of the Company or their associates still hold 5.8 million of granted options to acquire the Company’s share at exercise price of HK$4.11 per share.

Dr. Bryan Lin, Xiaohui, Chairman of Realord Group expresses “We are very confident of the development prospect and future of Realord Group. We expect different business segments of the Group will maintain growth and would like to express the management’s affirmation and support to the Group through increasing shareholding in Realord. We will continue to strike for greatest return for our shareholders.”

Liu Junlin, member of the Standing Committee of Shenzhen Futian District Committee & Director of the United Front Work Department visits Realord Group

On September 5th, Liu Junlin, member of the Standing Committee of Shenzhen Futian District Committee & Director of the United Front Work Department, accompanied with Dr. Bryan Lin, Xiaohui, Chairman of Realord Group, also known as the Chairman of Shenzhen Futian District Federation of Industry and Commerce & General Chamber of Commerce and Party Secretary of the Shenzhen Futian District Federation of Industry and Commerce & General Chamber of Commerce Shi Youjun, led a team to visit Realord Group’s Shenzhen Office and held a meeting. Nearly 30 Vice Chairmans of the Shenzhen Futian District Federation of Industry and Commerce (General Chamber of Commerce) participated in this meeting.

During the meeting, Liu, Member of the Standing Committee of Shenzhen Futian District Committee expressed that today’s visiting Realord Group was aimed at learning the management experience from the corporate to seek for opportunities in cooperation with each other; providing mutual learning and exchanges for a new session of the leaders from Shenzhen Futian District Federation of Industry and Commerce (General Chamber of Commerce); hoping to enrich the activities of the Federation of Industry and Commerce, unifying thoughts, forming consensus through the communications and making contributions in the development of the non-public economy and the business environment in Futian District, Shenzhen.

Liu believed that this visited was very fruitful that she could know more about Realord Group in a deeper and more stereoscopic way. Meanwhile, She affirmed Dr. Bryan Lin’s active participation in the discussion of the politics affairs so as to improve the business environment in Shenzhen and Hong Kong, and his charity contributions.

Thanks to the pioneering works of reform and opening, the Shenzhen-Hong Kong companies, including Realord Group, have been able to flourish, a number of outstanding enterprises, namely Tencent and Huawei, have been created. Therefore, we must firmly keep confidence and seize historical opportunities.

"if we say reform and opening is the major opportunity for previous 20 years, then the new ear of socialism is now another new historical opportunity. In the Greater Bay Area of Guangdong, Hong Kong and Macau, in Futian District, Shenzhen, we should keep up with the times.” Liu said.

Liu stressed, “one generation has its own missions, our new session of Shenzhen Futian District Federation of Industry and Commerce should have new ethos and actions. We must have our own unique temperament and spiritual pursuit in the forefront, being courageous to finish missions and to take responsibilities.